The Quick Guide to Company Updates

Gust

APRIL 18, 2024

Are you producing and distributing regular company updates to your network? Here's why you should. The post The Quick Guide to Company Updates appeared first on Gust.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Gust

APRIL 18, 2024

Are you producing and distributing regular company updates to your network? Here's why you should. The post The Quick Guide to Company Updates appeared first on Gust.

Gust

MARCH 5, 2024

Some very small businesses—particularly those that offer the professional or personal services of a single individual—can be launched and grown with few or no resources other than human time and talent. But most businesses require some money before they can be started—to pay for software, buy tools or equipment, lease office space, or pay for the time worked by employees or outside contractors.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Gust

FEBRUARY 14, 2024

It’s Delaware Franchise Tax Season! If you’re incorporated in Delaware and you’re staring at a terrifying notice with the number $85,165.00 on it, don’t panic. It’s very likely that your startup only owes $400. Read on for details on how to refigure your bill, easily file your report, and reduce your stress in future years. The post Don’t Panic! Your pre-revenue startup doesn’t owe $85,165 in Delaware Franchise Taxes appeared first on Gust.

Gust

DECEMBER 14, 2023

When people hear about the 25 percent annualized rate of return that active angel investors obtain, they assume that there must be some secret involved—perhaps an old-boy network of hidden links that connects angels to brilliant entrepreneurs and tech innovators or a mathematical algorithm developed by some genius at MIT that helps angels identify and invest in the businesses that are guaranteed to be the Apples, Googles, and Facebooks of tomorrow.

Gust

NOVEMBER 8, 2023

Even in this age of videos and text messages, the quickest way to kill your startup dream with investors, business partners, or even customers, is embarrassingly poor writing. Being very visible in the startup community, I still get an amazing number of badly written emails, rambling executive summaries, and business plans with one paragraph per chapter.

Gust

NOVEMBER 1, 2023

Pitch decks for demo day. Goes without saying that raising capital is a critical moment for any startup. It’s your first impression that can essentially make or break (figuratively) the opportunity at hand. Branding is what sets one business apart from another. It's what makes Apple a luxury tech brand and Nike a reputable sports brand. Understanding how to create an effective branding strategy can help your startup stand out on your big day.

Gust

OCTOBER 13, 2023

A note is a loan. That is, a lender gives a company $100, and the company writes a note to the lender stating "we will pay you back $100 one year from today, along with 10% [or some other number] per year interest". The convertible part means that in addition to the straight repayment mentioned above, the lender and the company agree that instead of the company paying back the loan in cash, if the company raises money by selling stock to another investor before the loan is due, then the original

Gust

SEPTEMBER 22, 2023

A C-Corporation, often referred to as a “C-Corp,” is a legal business structure that separates the company from its owners, providing limited liability protection to shareholders. It is the most common type of corporation in the United States, offering several benefits and flexibility for startups aiming for rapid growth and outside investment. The post What Is a C-Corporation?

Gust

SEPTEMBER 8, 2023

Taking in angel or venture money requires a setting of an entrepreneur’s expectations that may come as a shock at least at first. From the moment such an investor looks seriously at your company, the investor or VC partner is thinking of the end game, the ultimate sale of the company or even of an eventual initial public offering. There is no middle ground.

Gust

SEPTEMBER 1, 2023

Starting a new business is exciting. Founders often have a mental image of how they imagine their new company will be: the new Google. But before they can create a new verb, they first need to make sure that they have the best corporate setup, have raised adequate funding, have commercial contracts to protect their interests, and that their intellectual property, including patents and trademarks, are protected.

Gust

AUGUST 21, 2023

For many entrepreneurs, their first experience with corporate law occurs when they decide to organize their fledgling business into one of the several forms of business entities permitted by law in most states. For the first-time business owner, the options presented by legal counsel can be confusing, in part because the differences among some types of business entities are subtle or highly technical.

Gust

AUGUST 7, 2023

When your startup is very small, it’s fairly easy to gauge its health. From your vantage point as the company’s leader—and perhaps its only employee—you can readily track the arrival and departure of customers, the growth or decline of revenues, and changes in profitability as costs rise or fall. But as your company grows and its complexity increases, measuring the success of the business becomes more difficult.

Gust

JULY 11, 2023

As the influence of artificial intelligence continues to extend its reach across a diverse range of industries, the question remains: What legal rights do AI users have in output generated by AI systems? In a previous post, I reported on the recent announcement by the U.S. Copyright Office, which took the position that most AI output would be unprotectable by copyright because it is created by a machine rather than a person.

Gust

JUNE 16, 2023

When you run a startup, securing the right types of funding at the right moments can feel like a never-ending game of chess. You have to think twenty moves in advance, and if you make just one mistake, you might end up sabotaging the whole game. And plenty of founders do sabotage the game: It’s estimated that 80% of startups don’t make it past the first year, and 90% fail over the long run.

Gust

JUNE 16, 2023

When you run a startup, securing the right types of funding at the right moments can feel like a never-ending game of chess. You have to think twenty moves in advance, and if you make just one mistake, you might end up sabotaging the whole game. And plenty of founders do sabotage the game: It’s estimated that 80% of startups don’t make it past the first year, and 90% fail over the long run.

Gust

JUNE 8, 2023

Number one, understand your business. It sounds obvious, but the majority of entrepreneurs who pitch me have obviously never thought through many of the major issues surrounding their companies. You should know EVERYTHING about your business, product, customers and competition. You should know every metric regarding customer acquisition, conversion and retention.

Gust

MAY 10, 2023

Enployable, Inc. is the world's first value-based AI job matching platform. After witnessing the challenges that my friends faced while looking for new jobs during the pandemic, I wanted to find a better approach to the job market. Traditionally, the hiring process focuses on whether a candidate's skills and experience match the job description, and the process of screening candidates can be labor-intensive.

Gust

APRIL 21, 2023

In recent years, artificial intelligence has emerged as a powerful tool for generating original works. The question of who owns the copyright to these works, however, has become increasingly complex. Copyright registration in the United States has traditionally been limited to human creators, but with the rise of AI-generated works, the distinction between human and machine-made creations has become less clear, leading to uncertainty around copyright ownership and register-ability.

Gust

APRIL 13, 2023

Don’t misunderstand sweat equity. It’s a bucket term that means different things in different contexts. Fundamental sweat equity is beautiful, blisteringly clear, and real. Most other sweat equity is full of potential problems, misunderstandings, and disappointments. The post Don’t Misunderstand Sweat Equity appeared first on Gust.

Gust

MARCH 21, 2023

It is 2023, and the environment for funding has changed drastically in the last few years. What you do before you pitch is even more important than it has been in the past. The post 5 Things To Do Before Pitching Your Business To Investors appeared first on Gust.

Gust

MARCH 14, 2023

The average length of a funding pitch to angel investors is ten minutes. Even if you have booked an hour with a VC, you should plan to talk only for the first fifteen minutes. The biggest complaint I hear from fellow investors is that startup founders often talk way too long, and neglect to cover the most relevant points. Or they get sidetracked by a technical glitch due to poor preparation.

Gust

MARCH 6, 2023

Starting and building any business other than the very tiniest one-person shop is a complicated task. Thus, the majority of businesses that aspire to become high-growth companies of the future—are launched by a founding team of two, three, or more people. Combining the strengths, insights, experiences, talents, connections, and resources of a few people often gives a new business a greater chance of success than resting entirely on the shoulders of even a highly talented single individual.

Gust

FEBRUARY 14, 2023

Taxes is like the sands on the beach by my house, it is a constantly changing world molded by the tides of public sentiment and the seasons of political changes. Sometimes I walk down and there is a ton of sand and everything is smooth and easy to walk on. Other days the sand is sucked out, leaving rocky crevices where my feet are constantly at risk of a cut.

Gust

DECEMBER 15, 2022

Any company incorporated in the State of Delaware, regardless of ownership, must file every year by March 1st, or receive an automatic penalty. Learn more about the Delaware Franchise Tax. The post Delaware Franchise Tax Explained appeared first on Gust.

Gust

DECEMBER 6, 2022

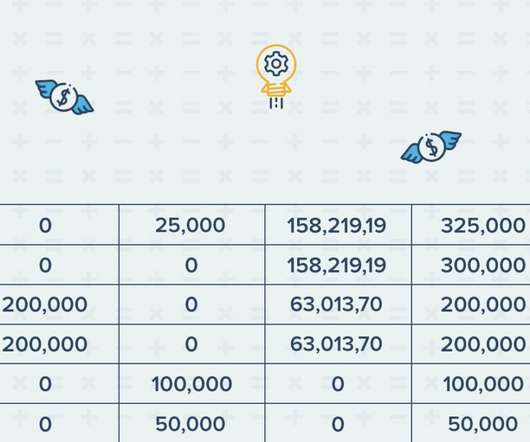

Convertible notes are a great tool for venture financing. They are primarily used for early-stage financings, but they are also a good solution for a bridge round when a company isn’t quite ready for the next equity financing round. The actual mechanics of converting convertible notes (in other words – calculating conversion shares) is not a simple task and requires great care.

Gust

NOVEMBER 22, 2022

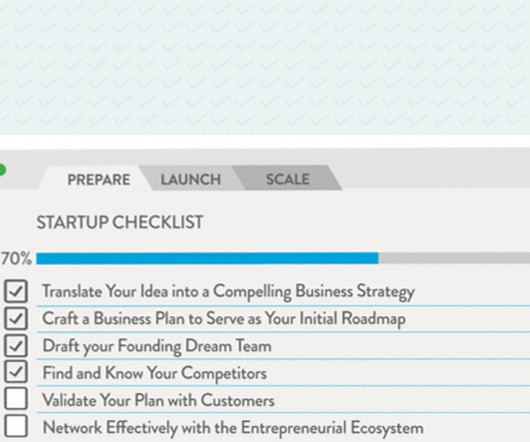

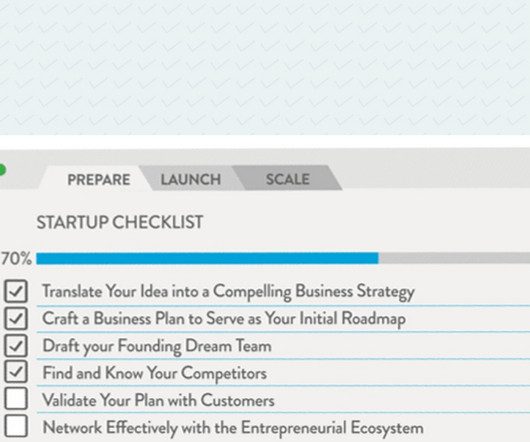

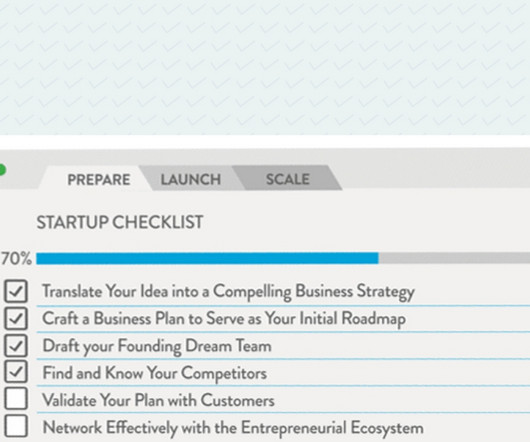

Throughout the years of developing Gust.com and Gust Launch, we recognized a common pain point in the startup journey. Founders, the passionate entrepreneurs pouring all of their efforts into building their ventures, had questions about how to properly set up their startups. They ask those early questions: What should we be doing? How do we set it up?

Gust

NOVEMBER 8, 2022

You can’t succeed in business without an operational model that delivers value to customers at a reasonable price, with an underlying cost that allows you to make a profit. There are no “overrides” – for example, businesses don’t thrive just because they offer the latest technology, or because everyone wants to be “green,” or because their goal is to reduce world hunger.

Gust

OCTOBER 28, 2022

As a founder, you likely have a lot on your mind. Raising capital for your startup is probably near the top of your mental "to-do" list, but chances are you haven't really gotten around to starting on it just yet. It’s important to raise capital to support growth and scalability in the early stages. While it might be a stressful task, raising capital isn't really something you can leave on the back burner.

Gust

OCTOBER 17, 2022

How has fundraising changed in the last few years? Between COVID, the evolution of the API economy, and a increase in second, third & fourth time founders who are seeking funding. Janelle van Deventer breaks down the options for raising capital through bootstrapping, dilutive investors, government subsides and various forms of debt. The post How To Raise Capital and How Raising Capital Has Changed appeared first on Gust.

Gust

OCTOBER 1, 2022

Angel investing in the past few years has moved from an arcane backwater of the financial world to a business arena that receives coverage in mainstream newspapers and hit television shows such as ABC’s Shark Tank. Today, any sophisticated investor with a portfolio of alternate assets should consider direct, early-stage investments in private companies as one potential component of that portfolio.

Gust

SEPTEMBER 21, 2022

The Inflation Reduction Act is a sweeping $750 billion health care, tax, and climate bill that was signed into law on August 16, 2022. There is a lot of news about this significant legislation and what it’s doing for lowering drug costs and subsidizing clean energy. One topic that isn’t getting enough attention, however, is that this bill is big news for small businesses and startups.

Gust

SEPTEMBER 15, 2022

Krezzo Co-founder Stephen Newman talks cross-departmental operational alignment with OKRs (Objectives & Key Results). When start-ups begin to scale, one of the first things that becomes a big problem is keeping track of the core business priorities and performance across teams. When implemented and adopted successfully, OKRs essentially becomes your company’s playbook enabling your company to focus more on solving problems than doing homework.

Gust

SEPTEMBER 6, 2022

Before a technology startup becomes a company, it spends a period of time as simply a project. The founding team is usually one or two individuals building and testing products as they try to validate a demand for them in the market. At some point, founders ask themselves: when is it time to turn this project into a company? The post When Should a Tech Startup Form a Company appeared first on Gust.

Gust

AUGUST 26, 2022

Did you miss filing form 5472 at some point? Normally this means big penalties that are nearly impossible to waive, but finally there is some relief. The IRS sent out a news blast today with some great news for corporations that file form 5472 - they are waiving penalties on late filed international information returns for 2019 and 2020. This is huge for corporations with foreign owners, as many have avoided filing for fear of the $25,000 per form penalty being assessed.

Gust

AUGUST 5, 2022

When you hear the word crowdfunding, the first image that jumps to mind is Kickstarter. We all know how this crowdfunding site works. You donate money to a company or cause, and in return you get early access to the product/service, SWAG, or a combination of both. With equity crowdfunding, individuals invest in startups and […]. The post What Is Equity Crowdfunding appeared first on Gust.

Gust

APRIL 8, 2022

Startup founders need to be Jacks or Jills of All Trades. They are visionaries, product designers, bookkeepers, and tech support representatives. But the single most important role of the founder is to be an effective communicator. And in the context of a startup, that means “storyteller”. The founder needs to paint a mind-picture of a […]. The post The Startup Founders Pitch Toolbox appeared first on Gust.

Gust

MARCH 18, 2022

A number of years ago I worked in product for Gust Launch. As a disclaimer, I am a staunch believe in the mission of Gust Launch and—more generally—decreasing the barriers to entrepreneurialism and innovation. One of the things we did during my time at Gust Launch was form the Startup Legal Counsel network that is […]. The post The Importance Of Being Connected To The Right Lawyer appeared first on Gust.

Gust

MARCH 24, 2022

Welcome to the Gust Launch Founder Spotlight! Gust Launch supports a variety of exciting founders doing amazing things. In this ongoing series we’ll highlight the experiences of Gust Launch founders, in their own words, as they navigate the challenges of early-stage entrepreneurship. Want to share your story? Reach out at spotlight@gust.com. The Founder, the company, and why […].

Gust

APRIL 8, 2022

Startup founders need to be Jacks or Jills of All Trades. They are visionaries, product designers, bookkeepers, and tech support representatives. But the single most important role of the founder is to be an effective communicator. And in the context of a startup, that means “storyteller”. The founder needs to paint a mind-picture of a […]. The post The Startup Founders Pitch Toolbox appeared first on Gust.

Gust

APRIL 15, 2022

Should I convert my LLC to a Delaware C-corp? Maybe you formed your company in your home state initially for cost reasons or because it seemed like the simplest path to formation. Maybe you formed as an LLC instead of a Corporation so you could enjoy the tax advantages of a pass-through entity. These are […]. The post Converting an LLC to Delaware C-corp appeared first on Gust.

Gust

APRIL 28, 2022

Every early-stage startup has a unique set of constraints it must deal with and trade-offs that must be made along the way to launch its product into the market. From product development, to legal, to go-to-market strategy, even the most seasoned startup founder can make potentially business-crushing missteps. Luckily, there are some common product development […].

Gust

MAY 24, 2022

This post originally appeared on Kader Law’s blog. We’ve all received those emails in our inbox – “We’ve updated our terms of service!”. Why do the biggest companies in the world repeatly spam us and make us accept their terms of service? While you are not legally required to have a terms of service agreement, the […]. The post Does my startup need a terms of service?

Gust

JUNE 1, 2022

This post originally appeared on Startup Stack’s blog. If you have raised capital from investors before, you probably noticed that one of the first requests from potential investors is for you to send them your current cap table. Why would an investor be so interested in seeing your cap table? What might they be looking for? […]. The post What Your Cap Table Tells Investors About You and Your Company appeared first on Gust.

Gust

JUNE 8, 2022

This post originally appeared on Capchase‘s blog. How to protect your SaaS business during market uncertainty Public tech stocks have been on a downward trend the last few months in the US & Europe. Looking at SaaS specifically, Byron Deeter, partner at Bessemer Venture Partners, said the median company in their index of subscription software stocks is down 53%, […].

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content