How to Estimate a “Net Value” for Your A/B Testing Program

ConversionXL

MAY 29, 2019

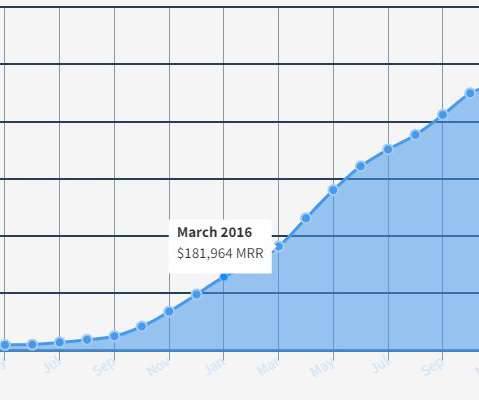

But when you want to deliver a realistic impression of their added value, have a skilled person from your team or agency correct the projected (or “discovered”) uplift to a more accurate “net value.”. The “net profit” calculation is a better way to estimate the impact of the initial results we get from a series of A/B tests.

Let's personalize your content