Business Valuation: Determining The Worth Of A Company

YoungUpstarts

JUNE 16, 2020

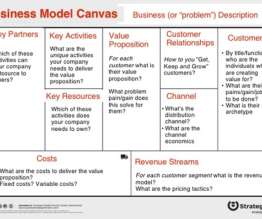

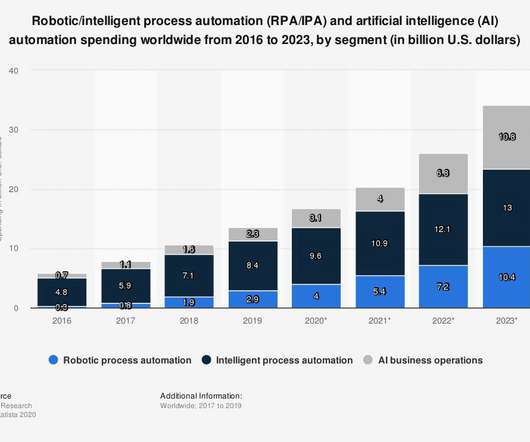

Business valuation is defined as a way to determine the overall economic value of a company , and is a necessary component of a sound business plan and strategy. Any of these situations will demand a valuation to determine current and future projected value. . Three Methods of Valuation. Also referred to as Book Value .

Let's personalize your content