GRP Announces $200 Million Fund. Rebrands as Upfront Ventures

Both Sides of the Table

JUNE 27, 2013

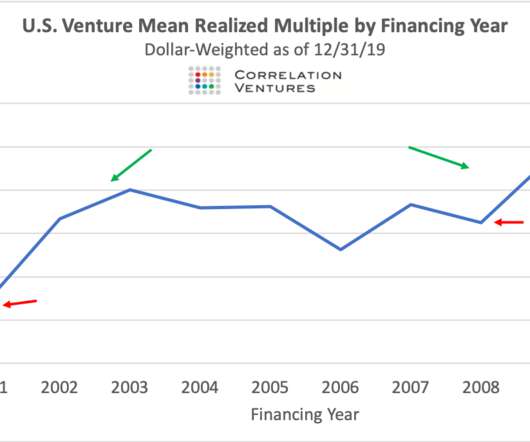

We have previously raised funds in 1996 ($200 million), 2000 ($400 million) and 2008/9 ($200 million). Santa Monica is the place where the highest concentration of early-stage startups are created if you consider also the contiguous geography of Venice Beach. Let’s start with the fund. What’s up with that?

Let's personalize your content