Is the Lean Startup Dead?

Steve Blank

SEPTEMBER 5, 2018

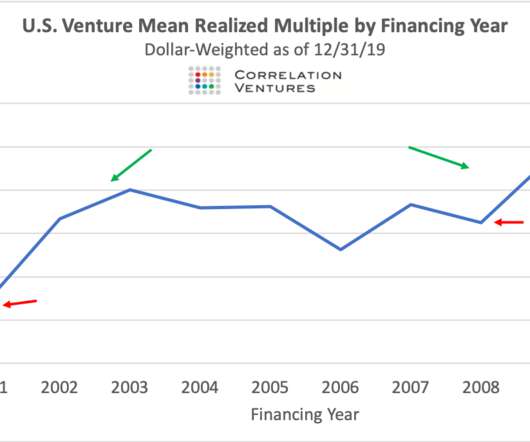

Most entrepreneurs today don’t remember the Dot-Com bubble of 1995 or the Dot-Com crash that followed in 2000. The idea of the Lean Startup was built on top of the rubble of the 2000 Dot-Com crash. And if the company does go public, the valuations are at least 10x of the last bubble. It’s the antithesis of the Lean Startup.

Let's personalize your content