Early Stage VCs – Be Careful Out There

Feld Thoughts

JULY 19, 2018

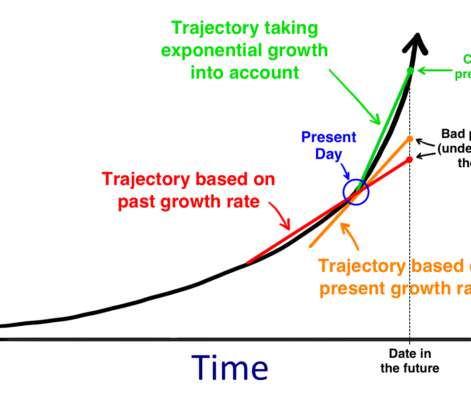

In addition to our own funds, we are investors in a number of other early-stage VC funds as part of our Foundry Group Next strategy. “Historically, the $10 million valuation mark has been somewhat of a ceiling for seed stage startups. All the experienced finance people I know talk regularly about cycles.

Let's personalize your content