2010 VC Funding Outlook for Startups – Prepare for Winter (Part 3/3)

Both Sides of the Table

OCTOBER 1, 2009

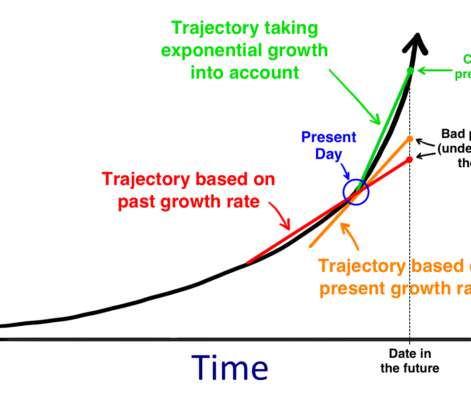

I obviously don’t have a crystal ball so the economy could fare better than my gut, but here’s why I’m cautious for some time in 2010 or early 2011: Why is the future still so unpredictable? We spent our future since the equity was artificial. Consumer spending is where I’m dubious. So why the ’09 bounce?

Let's personalize your content