6 Reasons Your Hockey Stick Growth Curve Can Go Flat

Startup Professionals Musings

MARCH 20, 2020

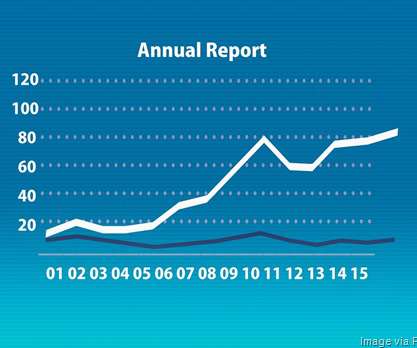

Every entrepreneur thinks he can relax a bit after his business model is proven, funding is in place, and revenues are scaling as projected up that hockey-stick curve. Unfortunately, the mainstream customers who can really drive revenue care more about price. Customer acquisition gets harder and more expensive.

Let's personalize your content