7 Goodwill Factors Will Raise Your Business Valuation

Startup Professionals Musings

MARCH 12, 2022

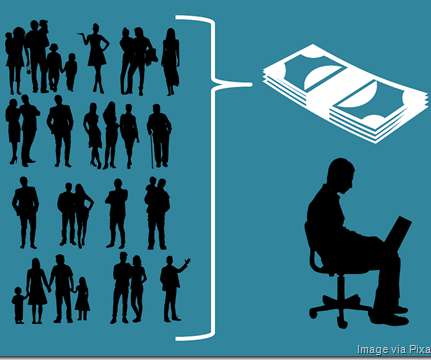

When it’s time to sell your company, or get new investors, valuation is the key parameter to success or disappointment. In my experience as an angel investor to startups, goodwill disagreements are perhaps the most common reason that you will fail to close interested investors as an entrepreneur.

Let's personalize your content