Conversion, retention and churn benchmarks

VC Cafe

FEBRUARY 21, 2023

In a contracted venture capital environment, where external funding is more difficult to raise, founders know that they need to make due with less, and extend the runway further.

VC Cafe

FEBRUARY 21, 2023

In a contracted venture capital environment, where external funding is more difficult to raise, founders know that they need to make due with less, and extend the runway further.

David Teten

SEPTEMBER 23, 2017

Private equity and venture capital investors are copying our sisters in the hedge fund and mutual fund world: we’re trying to automate more of our job. The majority of funds are using the popular B2C websites and services for basic due diligence, e.g., Linkedin, Twitter, HackerNews. ff Venture Capital portfolio company.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

VC Cafe

JULY 26, 2020

“After the crash, venture capital was scarce to non-existent. With the risk of sounding too conservative, what matters for startups now, as venture capital becomes less available and consumer spending tightens, is adaptation and survival. In fact, they were screaming at them to dramatically reduce their burn rates.

VC Cafe

SEPTEMBER 22, 2022

The term ‘Centaur’, coined by venture capital firm Bessemer, indicates companies that achieved $100M in annual recurring revenue (ARR). Scaling to $100 Million from Bessemer Venture Partners. But becoming a Unicorn, or receiving a billion dollar valuation is no longer an indication of growth.

VC Cafe

AUGUST 3, 2023

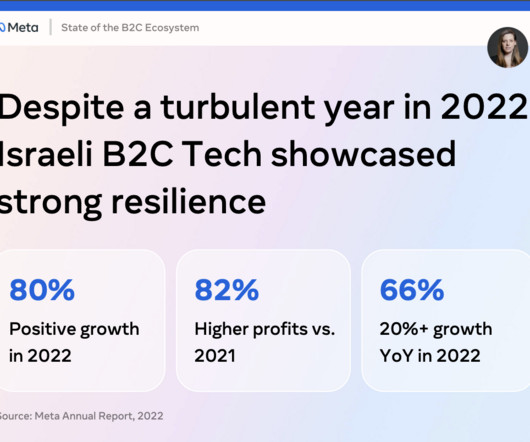

While Israeli startups successes are well known in the B2B space (cybersecurity, enterprise tech, devops…), B2C startups are unsung heroes… The landscape of B2C tech in Israel is blossoming, despite several challenges. Israeli B2C – Let’s start with the high level picture. Much has changed since then.

online.wsj.com

SEPTEMBER 23, 2012

SIGNIFICANCE PROMINENT. --> The Venture Capital Secret: 3 Out of 4 Start-Ups Fail. An entrepreneur with a hot technology and venture-capital funding becomes a billionaire in his 20s. The National Venture Capital Association estimates that 25% to 30% of venture-backed businesses fail. NAME David Cowan.

VC Cafe

SEPTEMBER 26, 2022

It doesn’t matter if your company is B2B or B2C, as Y Combinator puts it, you need to build stuff people want, and obsess about making it as user friendly, friction free and smooth as possible. 2021 gave us plenty of examples for bad governance in both startups and venture capital. Bill Gates , founder of Microsoft.

Let's personalize your content