Valuations 101: Scorecard Valuation Methodology

Gust

OCTOBER 20, 2011

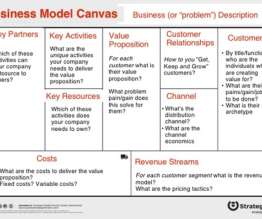

In 2011, the valuation of pre-revenue, start-up companies is typically in the range of $1.5–$2.5 Scorecard Valuation Methodology. This method compares the target company to typical angel-funded startup ventures and adjusts the average valuation of recently funded companies in the region to establish a pre-money valuation of the target.

Let's personalize your content