Brand Marketing vs. Product Marketing: What’s the Difference and Which Should You Invest In?

ConversionXL

JANUARY 18, 2022

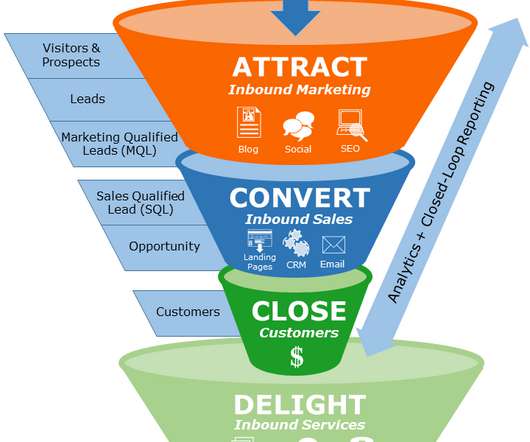

It partners with sales to close more revenue, informs product teams to deliver better products, and in some cases, co-owns demand generation activities with marketing teams. of their time), marketing teams (84.2%), and sales teams (75.9%). Use product marketing to boost reach and sales. Image Source.

Let's personalize your content