Ash Maurya, Founder/CEO, LeanStack

Ash Maurya is the author of ‘Running Lean’, ‘Scaling Lean’ as well as the Lean Canvas business modeling tool.

Ash is driven by the search for better and faster ways for building successful products. He has developed a systematic methodology for raising the odds of success built upon Lean Startup, Customer Development, and Bootstrapping techniques.

Slides, Video, AMA & Transcript below

Slides from Ash’s talk

Video

AMA

Learn how great SaaS & software companies are run

We produce exceptional conferences & content that will help you build better products & companies.

Join our friendly list for event updates, ideas & inspiration.

Transcript

Ash Maurya: Ok. All right! Hello, everyone!

So I’ve been an entrepreneur for over a decade now and throughout that time I’ve built dozens of products. Something that you will appreciate, all my ideas started out as my ideas, not all of them went on to become awesome products! Like everyone else, I’ve had more successes than failures but I knew that good ideas are rare and hard to find and so you’ve got to go through all those bad ideas before you get the really good ones. That didn’t bother me, so I knew that this was going to be a search process and being an entrepreneur you have to search for those good ideas so I was prepared for those ups and down but what bothered me was the cycle time between those ideas. You see, at the time I was averaging 1.5-2 years between ideas. That’s when I had the spark and I knew when to double down on the idea or give up on it. That was too long. So, in the beginning it didn’t bother me as much but as you can tell, time doesn’t wait for anyone. So, at some point I began to realise that I wasn’t getting any younger and had more ideas than time and this became my mantra – life is too short to build something nobody wants [laughing], or not enough people want.

So, that’s when I started introspectively studying what I was doing and I was trying to find some kind of process or meta process. That’s when I ran into some of the early words from Eric Ries from the lean start-up, some of you probably heard of that, Steve Blank on customer development and I jumped on the conversation because I thought some of what they were saying resonated with the mistakes I made and I wanted to find a better process.

And here’s what I found, this is where I found where we waste most of our time. When we get hit with an idea, we often do one of two things. We either lock ourselves up in the metaphorical garage and start building our product or solution or we surface at some point and start looking for resources. So, we go to our stakeholder, we go to our team members and we try to build up those resources so that we can build a solution and the magic happens. And I found over the years that this is backwards approach, it’s backwards because when you start by talking to those stakeholders, they don’t care about the solution or product, they want to see the ROI (return on investment). So, they want to see evidence in other words that people other than yourself, your team or mom care about this idea. So, that pipeline of customers. If you go and show your product to customers when it’s half finish I will argue that that’s worse than showing them no product because they too at that point don’t see what you see and you’re asking them a big leap of faith to jump with you. At this stage, you’re stuck because you don’t have the resources to continue finish your product and customers don’t help you along the way. So, there’s a better way but first we need to understand why this happens, why do we keep going around in circles, building products this way?

#1 reason why new products fail

So, the reason that I found is that the world has changed. We’ve gone from a scarcity economy where it used to be expensive to do things and where now we’re in an abundance economy it’s cheaper and faster than ever before to build product. The question is not can we build something but should we build something? So, the number one reason now that products are failing is not because of failure in building the product but because we build the wrong product. We waste needless, time and money building something that ultimately nobody wants. Then we have to ask ourselves why does that happen and I lay the blame there, on us, the innovators, entrepreneurs because we fall in love not necessarily with the idea but the solution that we have thought upfront.

So, when we look at our ideas, they look like this. The thing that comes most clear to us is the solution bogs and we sometimes don’t even know that’s happening. I can show many examples of this as we go along. So, going back in time when I was trying to look at myself, I found that I was building a lot of awesome solutions, but they weren’t turning into awesome business models and this was my first mind shift. I had to shift away from thinking at the solution and the product – and this was the spark and epiphany I had that started this book – any readers of running lean in the audience? Thank you! That was the big idea in the running lean book. I won’t sit here and talk about all the details but I want to give you a summary of some of the big ideas or framework behind the book cause we will build on that as we go along.

I’ve been a tech entrepreneur for over 10 years and I knew how to build product so when I started thinking of the business model as a product, it’s simply a matter of applying product development best practices to business model development and create some best practices. So, you will probably recognise some of these steps here, we will quickly walk through them.

The first step is one of documenting your initial plan. If you’re trying to build a complex thing like a house, we start with some kind of an architectural sketch or plan. Our start-ups are new ideas and they are even riskier than building houses so as entrepreneurs we are especially gifted at rationalisation and what I mean by that if we launch our product in the summer and it’s not selling it’s obvious it’s because everyone is on holiday. When they come back in the fall and it’s still not selling it’s because they just got back from holiday and their kids are going back to school and here in the US it’s Halloween and Thanksgiving and Christmas so there’s a reason why you never can sell a product. I can pick every month of the year and create a reason why the product doesn’t sell. So, you want to avoid that kind of rationalisation and draw a line in the sand. Typically, we used business plan or cases. Anyone done it with a business plan before? I see a lot of half hands. Keep your hands up if you enjoy the process [laughter] so all the hands are down now. I don’t blame you. I’m not against the business planning as an exercise cause it’s a great exercise for getting those critical assumptions out but the business plan as a format is broken because it takes too long to write, no one will read it so why waste your time do it?

In more recent years we started talking about the business model. Alex Ostewalder has been here a few times and you’ve probably been exposed to the business model concept. This is essentially a one page business plan. This is my derivative model over the original canvas – it’s called LEAN canvas and if you haven’t written a business plan before you still can recognise a lot of the building blocks here. They describe who are your customers, and what problems do they have, how do you take them to market, what solution you build? So you talk about the business model story using one of these things. This is all there is, there is not other pages to this, it’s designed to fit in a single page because by the time you go and talk to your team or stakeholder, your idea needs to be easily communicable. You cannot be spending a lot of time trying to get that across.

So, I look at these building blocks on the canvas a lot like the Lego pieces in the early days. You can take it and build some very simple models like this and with the same blocks build more elaborate models. This is a life-sized X-Wing they built not with giant pieces, but the same small pieces. So, we can take the same basic blocks in the lean canvas and describe simple and more elaborate projects. You will see some examples shortly. But that’s the first step, take your idea and break down into its component pieces.

Next step, identify what’s risky. That’s not necessarily what’s easiest in the plan. So, building product comes easy to a lot of us cause that’s what we most clearly see, but again the bigger question is will anyone care? So, you will need to find ways to test that and not just the technical feasibility aspect of it. So, that’s what this is.

And then finally we have the testing of the plan and this is where the LEAN start-up methodology really shines cause once you’ve identified what are those risky assumptions, we have learnt how to devise fast experiments and create a feedback loop from them to form all the risks and form the business model. This is the one page summary of what a business model development process might look like. Let’s put this to practice! It’s always good to take the theory and do a workshop, a little case study here.

Case Study

Over the years there were many examples. I started in software space, but I’ve used this to the writing of books. I’ve written my first and second book using a lot of these ideas. In fact, in the Running Lean book, the second chapter is a case study on how I wrote the book using every idea in the book so it’s a very recursive process there.

What is the riskiest assumption?

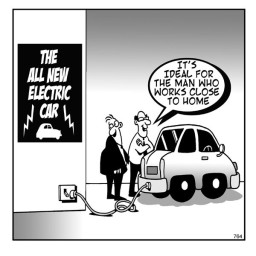

I will use the example you’re familiar with. It’s a product with a big vision. Elon Musk had a big vision, to create an affordable electrical vehicle. Massive. And some of you know the story as well so it will make it easier but the question to ask is; go back in time and if you were building an electric car, ask yourself what would be the risky assumptions and what is the riskiest assumption out there? You can shout out the answers. It’s brand new? That’s a solution, but what about the battery? Nobody knows who you are, sure. Thank you! So, those things are all valid, but one of the things that they found is that there was already a market for hybrid cars, people were already interested in the value proposition of an electric car was strong because gas prices were going up and people wanted to be green. So, that was in their favour but nobody knew Elon Musk so he had to build trust in the market but the thing they ran up against over and over again is if they put an electric car out there, the first question people would ask is how far does it go? And if it doesn’t go far enough it’s a non-starter. You can have all the green in your story but if it’s not going to be comparable to the existing alternative, it’s going to be a non-starter.

So, their big innovation was not really how do we build a car, but how do you build a better battery? When you build a battery, you have lots of options and that’s why when Tesla launched their first car, they didn’t even build it themselves. Does anyone know what this car is? It’s a lotus so they went to lotus and said let’s borrow your brand and car because we don’t have to innovate on the tyres, you guys know how to build tyres and people know how to drive this car. We’re gonna take out all the guts, and they paid the money to do that, and let’s stick our battery in here and sell it as the first one. This is an example of a minimum viable product, no other company did this before. But this was a non-traditional way for them to get into the market with something that really mattered and shortening the time to get it to market.

The more interesting question is why the Lotus? Their vision was to build an affordable electric car. This was an expensive one so why start with this one? Anyone has some ideas? Yes. Get the customer to pay for development? Looks cool? Light? So well-engineered [laughter]. Again, all of those kind of contributed but what happened is; two months ago, they launched and announced their affordable electric cars sub $35k and they got orders through the roof. So as an entrepreneur even if you are Elon Musk 5-10 years ago whenever they started this, going to announce a car and you get those many orders, you have to then scale from day one. You have to have factories, be able to build, deliver on the promise and have the infrastructure to do it. They avoided all of that, by purposely picking a really expensive car, they were able to not have to build at scale. So, if you look at the person who buys this car, they typically have – this is a trophy car and not a primary car so this is how we look at early adopters. So, they typically have 1-2 other cars in their garage so they will use it for the weekend or driving around and showcasing the electric car but not so much using it as a primary vehicle. If you think of it that way, what they did is they didn’t have to mass produce the vehicle from day one and they were able to test out the concept before having to scale which brings us to the 2nd mind shift here.

Scale your idea in stages

It’s when we look at a lot of people launching products and I know we’re at different stages here but when you look at big companies launching products at scale, we think every product has to go to scale day one and that’s almost never the case. There is actually a lot of power you get when you give yourself permission to launch your products in scale, which is why I liked this case study particularly. We look at other stories like Facebook and that also went through a staged launch more by constraints – they didn’t have the money to scale so they had to go college by college but that was also a gift in disguise but in this case, it was a deliberate part of the strategy.

Why another book?

And this is a nice Segway to some of the ideas in the second book so I write a lot for myself to clarify my thinking – that’s how I wrote the first book. Since it came out I engaged in many conversations with entrepreneurs, I worked with them on many products they built and some recurring questions came up which is what I attempt to answer in the 2nd book.

The first one is identifying what’s risky is quite hard and not that obvious. The starting risks are somewhat easy so we know we have to get down to customers and what problems they have – that’s where everyone starts and are obvious but beyond that, once you have your minimal viable product out there and get customers, things don’t get clearer but murkier. So, that was the 1st challenge.

The 2nd one was reporting on your learning was not enough. If we’re looking at the LEAN start-up body of work, we say learning is the measure of progress and I find that’s not enough so learning works when you’re out there, gathering hypothesis and you come back and work with your team but when you get in front of a stakeholder they want to see business results and often that’s when we start to spin numbers and we come up with whatever number to the right and pass that off as the reason we should get more money or resources and that is non-productive. So I was trying to find a single metric we can use with our teams to measure progress and externally with our stakeholders whoever those may be. This is what a I call a dichotomy of the progress story.

Finally, if we had good metrics that would be one thing but the world changed and we gone from a time when it was hard to measure things to now when we have an abundance of numbers. We can measure almost anything these days especially in software so what I see happening is not people getting clarity but people getting more lost. So, when I look at them and their aspiration to do a metrics dashboard I see them trying to recreate Jarvis from the movie Iron Man that talks to Tony Stark and tells him exactly what he needs to get done. That’s what we are all trying to build but in reality, we build the thing there on the right-hand side. So, we don’t get clarity but lost in these dashboards.

So, those are some of the questions I attempt to answer in the 2nd book. It’s also broken into 3 parts and I will quickly walk you through some of that.

Defining Progress

The first one is defining progress. The key question I was trying to answer here is what is the one thing that both your investors and stakeholders want and that the entrepreneurs and innovators want? And this is what I came up with.

We all want to see a graph that does this, so the hockey stick curve, what we sometimes will call traction. If I can walk into an investor’s office and I show them this graph, I will create a response. They will sit me down and they will ask me about my business. So, if I demonstrate that, that’s what gets the conversation started.

The problem though is that traction means different things to different people and it can be gained. So, if I show you these two graphs without looking at it in a lot of detail, most of you would pick the graph on the left, but this is the exact same data just plotted two different ways. So, if you take accumulated everything it would go up into the right, that’s the classic chart and not too long ago we’d play these games and use charting tricks to go into our stakeholder’s office and get them to look at growth when there really isn’t any growth in this example. Now more people can see through this façade and we have to up our game again so we have to get down to defining what traction really means and stop playing these types of games.

What is traction exactly?

“A business model describes how you create, deliver and capture value.”

Since I come from a business modelling mindset, I define traction as the output of the business model. Look at the business model as some kind of engine, whatever it spits out is what should be measured as traction. For that I went to a definition of what a business model is and I found this definition which I particularly like by Saul Kaplan “A business model describes how you create, deliver and capture value.” The first thing to realise here is that all of this is with respect to customers. We create value, deliver value to customers and capture some value back from the customer.

So, the Y axis of this graph has to be some customer behaviour. It’s not enough to measure traction in terms to see how much money you have in the bank, the size of the team or other proxies like that. It has to be some customer behaviour metric. The other thing is we can take these three jobs of the business model, put them side by side and there are two sets of equations that have to hold true.

Create Value > Capture Value = Deliver Value

The first is what I call the value equation. So, this is where we have to create more value and we capture it back. So, if I go down to the Starbucks down the street and they tell me the cappuccino there is $10, my perceived value is not that high of that cappuccino. And that’s where the value equation may not be met and I might just leave and not buy that cup of coffee. Does that make sense?

The 2nd equation it has to hold true is the monetisation and sustainability equation. This is where we have to capture more value than it costs us to deliver this value otherwise you don’t have a business, you have a hobby. Now I put greater than or equals here because we do have some not-for-profit in this room so their goal isn’t to maximise the gap between how much they get paid and how much they charge but rather still create profit but put it all back in the business to have more impact.

So, these two things have to hold true in the LEAN approach we start from left to right, so by first asking ourselves can we create value? That would be the value hypothesis, can we get customers to come and get value from our product? Then we move down to the other side, how do we capture it back and optimise it for profit? The thing I want to get your attention is the middle part here, the capturing value is the common factor in both these equations and that’s what I used to define traction. So, to me it’s the rate at which a business model captures monetisable value from its customers. That’s not the same thing as revenue, when you take this value it turns into future revenue and if you were an investor in a stock for instance, we don’t buy it for its present, but its future value. And that’s how you need to get your head around this concept.

3 business model archetypes

I will show you some examples and use some business models on how this idea works and there are lots of business models and we’re not gonna go over all of them because that will take you all day. I’m gonna take these archetypes of business models, there are three basics one, the direct, multisided and marketplace and I will use them to show you what we think of traction in each cases.

The Direct Model

The direct model is pretty simple, it’s an active model and you have users who become your customers. In this case I show a simple magic black box which we’ll uncover here shortly but you have these unaware visitors on the left, we put them through this black box where our product, marketing and sales lives and out it spits these happy customers. So the example I gave earlier on, Starbucks, works in this model. And we have never tried their coffee, we smelled the coffee beans we found something appealing in the menu, we order and become a customer. In this model, the simple definition of traction would be the rate in which you create all customers. All customers aren’t created equal so you try to figure out what is your type of customer, their average ticket price, how often you will get them back. But once you got that figured out, the rate at which you create customers is the throughput from the black box and that’s how we would measure traction.

So, that one is not that interesting but what’s more interesting are what are the leading indicators and behaviours that lead to traction? How can we identify those? So Starbucks, several years ago, did a study and they found that there was an anomaly in their user base so they had a small subset of people that were spending the most money and were doing something very weird. So, Starbucks was a coffee shop and we go to coffee shops to buy coffee and then we leave, these people weren’t leaving, they were sitting around in uncomfortable chairs because they weren’t comfortable yet. The bathroom was locked so every so often they got up to ask for the key, buy something then go to the bathroom and when they looked, they saw there were having meetings with other people and they would stay there all day and be working there. So, they began to realise they could double down on this and that’s when they rebranded the company and the tagline was the third space between the home and office because they realised what people hiring Starbucks for wasn’t just as a coffee shop but as a meeting space. And that became the key inside.

So, in that model, the leading indicator of where value was created wasn’t in the coffee but the space they were providing. So, the time spent in store correlated with money also being spent and they went through a massive rebranding and became a billion-dollar company but not by being just a coffee shop. So, that’s where you get the power of thinking in terms of those leading indicators.

Multi-sided models

So, let’s shift to the multi sided model and we’ll come to how you think of those leading indicators. So, if you take Facebook, that is the biggest and most classic multisided model. We have users and customers – I argue there’s no such thing as a free user, even though we all are using Facebook for free, we’re paying them with our attention and data, which Facebook very nicely capitalises. In their mind, we are a derivative asset. They do everything to give us a product we use and in exchange – that’s the derivative asset they’re capturing which they then sell to their real customers – in this case its advertisers.

If you’re Facebook when you’re talking about is your business model working in this case, you need two numbers. You need to talk about the exchange rate, so when you’re on Facebook and reporting your numbers, the first number you want to think about is is the size of that asset growing? So, your daily active users or monthly active users is the number that’s interesting because that’s showing you’re bringing more materials and users into future money and that’s where all the value is. So, is that value going up and to the right?

The second number we’re interested in is can you actually monetise that? This is where they would take a typical quarter, look at how much advertising money they have earned, divide that by the monthly and daily active user rates and come up with some average revenue per user. Even though we aren’t paying Facebook directly, we’re worth those numbers. When Facebook started in the US, they were earning less than $2 off of every user out there and now that number is up $12,13,14 is the most current number. So, that shows the business number is working and if they can communicate those two numbers, the stakeholders are happy.

Marketplace Model

Let’s do one more! If you look at the marketplace model, here we also have two sides to the model but we don’t just have users and customers. In this case, we have buyers and sellers. So, this would be your classic UBER, EBay types of models. Here it’s created not just when you have one side. In the previous example, you could create the happy users and then find the appropriate customers. In this case, you have to bring both sides together simultaneously. So, when you do that, you can conduct a transaction and that’s when you create happy customers and value here. Now what’s challenging here is you have to bring both sides simultaneously but from a traction perspective it’s not enough to measure the number of buyers or sellers, but the number of transactions. If you were Air BnB you would use the number of nights booked – think in terms of transactions. I started here and this gives you that one metric that you can use and that’s helpful so if you had a 1000-mile journey, getting clear on your traction metric is like figuring out what the mileage count is. So, are you headed in the right direction or not? This next phase is gonna talk about what to do when you’re not on the right track. So how do you figure out where you’re going astray and how do you course correct from there?

So, this is the prioritising waste part – so from a LEAN perspective this is a definition of waste. Waste is any activity that consumes human resources but adds no value in the process. If we go back to the LEAN literature, Taiichi Ohno who was the father of the Toyota production systems. He’s famous for his chalk circles – some of you may have heard the story. He’s famous for drawing these circles in the factory floor and getting his managers to stand in there because he typically would have observed something wasteful on the factory floor and that point it was very efficient and hard to see these things and managers would be standing for a shift or two and not see the same things. He wasn’t trying to punish them, it’s how the Japanese approached training. It was a continuous improvement type of exercise.

Now, a lot of the LEAN start-up work was influenced by this mantra of reducing waste and what I often saw is in the early stage of products, the problem wasn’t identifying waste, but prioritising it. So as an entrepreneur and product manager, we all wake up every day and there are 100s of things we want to have done. The key is understanding what are the right dominos to push, the right single or handful of things to actually do.

Theory of constraints

In the running LEAN book, I have this mantra in there also which is right action, right time which summarises that sentiment. This was a very philosophical approach, easy to say but hard to put into practice. So, I went looking in the manufacturing world to see where could I draw some inspiration? Before I became efficient they had to be inefficient. Before other factories become efficient, they had lots of waste as well. I found this body of work– anyone familiar with the book the goal? I’m thinking in this audience a lot of people. The big idea in this book – he was an Australian physicist and the idea is when you look at a business it’s not one giant process but a system of interconnected pieces and more importantly there’s only a single bottleneck or constraint at any given time. So, we can visualise this as a chain. If you apply stress it’s not gonna snap at every point, but it’s going to snap at the obvious weakest link. So, if you identify that link, addressing it should be priority number one. Trying to fix any of the other parts there is optimisations. So, future proofing those other links may be the right thing to do when there’s a lot of uncertainty like there’s with our product in the early days, that may be a form of waste. Don’t spend your time doing those type of things!

The other thing we learned from this metaphor is if we do identify the weakest link and we start working on that at some point it no longer becomes the weakest link so at that point, the bottleneck will shift somewhere else and unless we know where that is, we can fall into the local optimisation trap and we’ll see how this manifests itself in the business model. So the first thing to realise, before we can apply these techniques – I was inspired by this idea of constraints so I began to think that there must be something similar, a process that we can visualise as well on the customer factory floor – if we look at the output of a business being customers, there has to be something similar there. So, before you can prioritise waste, you have to be able to see that factory floor and that’s what I set out to do next.

Customer Factory

So, I showed a black box which was the metaphor for the different business model goals, but what I wanted to do next is figure out what are the steps? What is the blueprint of what a customer factory might look like?

Since the job of creating customers is about creating happy customers, I decided to be playful and take Disneyworld as an example since it creates the happiest customers on the planet, we will use that example here. If you were Disneyworld the factory would be your theme park. Your first job is acquiring raw materials into your factory. So, we would take the acquisition steps here where you bring them in, this might be an ad, online or radio ad. Someone hears it, learns about the theme park, listens and sees that they’re happy people there, decides they will take their family there for the next vacation. So, that would be the acquisition step.

The first operation we do on them once they arrive is the activation step. This is where we reinforce the promise we made early on. If you went to Disneyworld, you were expecting to see Mickey Mouse and have a good time. If you walk through those gates and seeing people in bandages and falling off rides and blood everywhere, that would be a terrible image and you would ask for your money back and never come back. The trick is trying to reinforce the proposition and get people to that aha moment as quickly as possible. If you can do that, they spend more time with you and that’s how we measure retention and they come back and spend more time in your factory. In the theme park as they spend more time, they will get hungry and buy concessions and gifts. When they get tired they might rent your own hotels if you were Disneyworld. And those are always how you begin to capture value from those customers. Once they leave, it’s not done yet. They go with their memories. They captured pictures and shares with their friends and encourage more people to come and visit Disneyworld. So, this is the blueprint of what I call the customer factory.

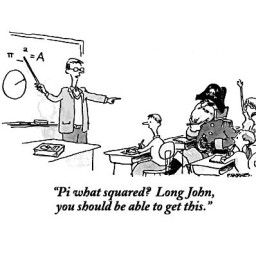

Pirate Metrics

Those of you who are familiar with these metrics, this is nothing new. You probably seen this represented in different ways. This is those 5 steps I talked to you about that Dave McClure popularised called pirate metrics. He called them that because now he’s an investor but before that he was a marketer at PayPal and he took the first letter of each of these words and spelled the word ARRR which the pirates like to say a lot and so he coined Pirate Metrics. Super popular, we often view this as a funnel. In the first book, that’s how I also use these metrics but I always struggled with a few things. One was the order of the steps.

Our customers don’t go through this like sheep from top to bottom – they go about this in a hap-hazard manner. So, you can’t think of it always as a funnel. It also lacked emotion – hopefully the other one conveyed some emotion to you and that’s what I found powerful. Some of these steps didn’t fit into any place, particularly the referral step. When do people refer your product? Is it when they activate? Is it when they are retained for some time? Are we paying for some time? Is it when they have paid you? If we look at it from this perspective, we can see that referral always happens when you create a happy customer. So, when you create that aha moment for them that’s where they’re the most incentivised and Gail talked about that yesterday. When you create those, you can incentivise them or put something in front of them and they’ll be more likely to refer. Interestingly enough, the reverse is true also. If you create enough unhappiness in your users, they will rebel and refer negatively and that’s bad word of mouth and we don’t want that either. So, creating that happy user also drives more retention, more revenue. So, that’s kind of the place to hone in on and figure out where are those value creating steps. So, I found this to be a nice visual representation of the ARRR metrics. But what it really got me excited was applying the theory of constraints to this which I want to talk about next.

Achieving Breakthrough

So, I took the theory of constraints and the 3rd part in how do we apply this and achieve these breakthrough? I took these 5 metrics and will walk you through the process. The first step is figure out which step your product is and mapping appropriate user actions for each of these steps. These are macro steps so there can be lots of sub steps in your funnel if you want to call it that, but you need to figure out what things will users do that you measure at each stage.

In this example, I’m taking a SAAS program that I’ve had, it’s 4 weeks into its early inception phase, we are running solution interviews which is essentially showing customers demos and if they like the demo we’re giving them the price and they’re signing up for the product for a 30-day trial. At this stage, we don’t have the product built, but we’re in the early stages of getting those early customers in. So, if you look at my acquisition step, I’m using some organic channels here – blog/Twitter/workshops. I’m driving them to a landing page where they’re indicating their interest on a teaser page, saying yes I’m interested in the value proposition you’re offering. I’d like to see your demo. We then do a in person call with them where we walk them through the product and if everything checks out we start a trial, there’s an engagement which is the retention step and after 30 days they will convert. So, we would collect their credit card upfront and not charge them up for 30 days, so your typical SAAS stuff. We always ask for referrals so that’s where they come in. So, if we have a customer that either buys or doesn’t buy, we say can you refer us to other like-minded people? Cause that’s the hard thing to do in the early days.

We can put some numbers to this, this is where we turn this now into a dashboard so we’re measuring these numbers a lot like a factory manager would – not an aggregate but in terms of runs. We use a weekly run here, you can use daily or monthly depending on your numbers – but we began seeing how many people we got in. So, we had 65 visitors to our site, out of them, 30 of them said yes, we want to be interviewed. We didn’t interview all of them, but 10 of them, there are some reasons but these are just the numbers we collected. Out of those 30, one of them turned to trial and some places where you don’t have data, like we had 30 day trials and nobody said charge my credit cards so we didn’t have the data at that point. Then we had some referrals and you can see that they’re at the bottom. With this, you can begin to draw those circles so apply the theory of constraint and not just thinking of a funnel and bottoms up, but begin to identify where the constraint is.

So, one tell-tale sign of where you find constraints is where you see inventory piling up. In this metaphor, your users are a work in progress they are a form of inventory that is flowing through the system. And our interviews were not very efficient so we were getting a lot of leads piling up. So, that was one sign that we had a constraint there. We also had a goal which we were not meeting and it was 7 trials a week. We only were converting at one trial a week which was well below the goal. That tells you there’s a constraint or bottleneck in the system. That was also when we had a lot of defects so we were talking to 10 people but only converting one. So 9 of the people we were talking to were just not good raw materials. Don’t call your users bad raw materials but this is just helpful to think of it that way, from using the metaphor. We knew that something was wrong there so we decided to kind of dive deep into that phase not add more leads, not try to monetise that one user with other things or build more futures for them, but identifying that constraint first.

There’s a technique in LEAN body of work called the 5 Y’s so we used that and identified two themes. One of it was the people that didn’t buy were just the wrong people, we were talking to the wrong prospects. The other was we didn’t specifically price it so people thought it was too expensive and would walk away. So, those were two actionable nuggets and we worked on both of them. And the first one we did was the easier one as we began to understand the persona and definition of what an early adopter would be and the first thing we did we went and began to qualify those leads better. You notice that even in the interview step, the fixes aren’t there so it’s a helpful visualisation. Sometimes you have to go upstream to fix a problem.

So, what happens when you qualify a lead? Typically, all the numbers go down for a while and I picked this very simple example to illustrate this point is that as we began to qualify our leads, this was a 3-part questions we asked them, we found the number of leads went down because we had more people coming to the site that would be actual customers. We found a number of interviews went down and that all seemed bad in the short term, but we did see is our number of trials more than doubled if you look at it on a relative basis.

Focus on a single key metric

And that’s the point of this visualisation, if we only look at one metric which you will see one mantra is working on her, is we’ve fallen into the trap of local optimisation and we often do some silly things when we are trying to optimise some local metrics without looking at it from a system perspective. You can still be focused on your key metrics but you always have to measure those life cycle events. I know yesterday people were asking about the differences between length of trials and whether you do annual versus monthly billing. All of them are examples of that kind of testing – fermium versus paid trials, because you can do those kinds of testing – if I give you a fermium product I know in the short term I will get more signups but the bigger question to ask is in the long term, do more of these customers convert and stay? You have to look at those longer term lifecycle events.

This also has ramification for how we build our team. A lot of people talked about that, David did a great talk on that, as you begin to grow your product – these are some of the scaling challenges, what we typically do is we specialise them and put them in departments and create these silos and we incentivise them with some in retrospect silly KPIs – so we tell sales people to sell, marketers to get leads, developers to write more code. Not too long ago we measured productivity in terms of line of code. Thankfully we don’t do that anymore – or the number of bugs fixed and some of the developers would write bugs and come back a few months later and collect their bonus cheques. All of those were examples of bad KPIs. Dharmesh began talking about how they found that when you incentivise sales people to sell, magically people close their accounts at the end of the month and collect their quotas but if you study those batches, people that closed and sold in the earlier part of the month typically are happier and retain longer than those at the end. It’s because at the end of the month, their aggressive tactics and all things are used – you can fix those types of things but you have to study those long cycle events. You go to a marketer, I’ve picked every one and let’s talk about them – you say give me more leads, they will ask you what’s your budget? Cause they can buy and give you as much traffic as you want and not be very good leads but you can get them. We can’t just look at these local KPIs and more on a whole level.

And that leads me to the last mind shift. If you look at constraints, they are very powerful because they help you hone in on what’s a hotspot but doesn’t tell you what to do about it. It tells you this is where you’re being most wasteful and where the risk is but you have to figure it out. I will share a story. We have this LEAN canvas online product – we had an activation issue so we measured that in terms of aha moments, people would come and create their initial canvas and fill out these 9-12 boxes and we saw that number began to drop. So, I went to my team and said look, this is where the problem is, we need to fix this pretty quickly. And sure enough all my team got to work and my designer came up with a design solution. So, their solution was the project is not simple enough, we need to improve the UX and signup at the on boarding process. My developers wanted to build more products and the marketers in the room wanted to improve copy or buy more ads.

And that is again another form of the innovator’s bias where all specialise in and when you’re given a problem, we all look at it from the things that we know and I call that the curse of specialisation. So, when you’re simply trying to brute force a solution without understanding the problem, that’s what happens. You look at a problem and you think you understand it, but typically it’s only a surface understanding. The analogy I will leave here with you is when you start with the solution it’s like building a key without knowing what door it’s going to open. And that’s not a very optimal way of doing things. So, if you’re in the early stage and start with an idea, it comes disguised as a solution and creating something like a canvas and just asking the question who is this customer that we’re going to serve and what problems are we solving, is a way to get your head around thinking in terms of problems.

Even when you have customers and they ask for things – some people brought this up also in the conference is they are often solutions disguised as feature requests. So, your customers and Steve Jobs said this well – are not well qualified to design solutions. It’s not the customers job to know what they want, that’s what Steve Jobs said and I see that a lot, your customers will find a problem but rather than telling you the problem they will think they know the solution as well and if you dig deeper and get the problem you actually can design a better solution to their problem. So, that’s where that manifests itself from a customer’s perspective.

Finally, we talk about running experiments. When you run experiments, you will get more failure than successes. In the early days the hockey stick is flat on purpose, we’re all looking for that killer feature, but if you pause and think about it logically, breakthrough doesn’t come from doing what you think will happen, but from the unexpected. So, if you look at discoveries like penicillin, microwave, gun powder and even in business, Google’s auction ad system, those were not things that were intentionally done and the thing to realise there is that all those entrepreneurs did something very fundamental which is where their experiment went awry they didn’t throw it out and asked a critical question. Why did this happen? And they studied that phenomenon even more.

Love the problem, not your solution

Again, if you run away from a problem in the LEAN start up world we have a pivot so I find teams often and they will say you should be proud of me cause we pivot a lot and we’re testing all kinds of things. And that misses the point because if you’re pivoting without understanding the problem or why you’re doing it, then that’s just a disguised see what sticks strategy. In all those cases – this is the third mind shift that I will leave you with, that you have to find a way to go under the surface and get down to the problems and when you use the analogy that I shared early on and start looking for doors and not building keys upfront, you actually end up opening doors that take you places. That’s all I have, thank you!

Q&A

Audience Question: So, when I saw the early part of your presentation your started talking about values – I started thinking about those 15-year-old books on how to insure profit and value through business model design. And I’m wondering what advice or experience you have on trying more non-standard business models themselves? Not just saying how can I sell this thing – oh it’s an exchange – but trying other shapes to try to address the problem or open the door to use your analogy. When someone implements the canvas, they did it and most of the time one of like 4 major ways. You talk about 3 different types of business models. The marketplace, the multipart model, and the business to business model. Have you found others more fringy or weird that you can use to the group could inspire us a little?

Ash Maurya: So, I would say within – so those are archetypes and if I look at the jobs and I find a job and this is all kind of playing off jobs to be done in framework, is that jobs are timeless and they transcend time and categories. If you look at the job of a business model it’s to create a customer. If someone disagrees with me, I’d love to hear that. The other thing is that those 3 basic things have to be met. You have to create value, deliver value and capture value. Now how that happens, that’s where innovation lies, that’s where – there’s a lot of room for remixing and a lot of room for if we look at the transition from enterprise software to SAAS and whatever will come down the road, those are where people get funky, the thing you’re describing. It’s the same job and we’re trying to deliver value to those customers, but the mechanism of delivery will change with time. So, that’s how I would answer that question, that there isn’t really a – as technology will evolve and we get AI and machine learning, more and more of those things are gonna shift away and new solutions are gonna be created but fundamentally the basics are still gonna be the same.

Mark Littlewood: Great! Ash, would you mind taking a table at lunch? Ash, thank you very much indeed! Really good [clapping].

Learn how great SaaS & software companies are run

We produce exceptional conferences & content that will help you build better products & companies.

Join our friendly list for event updates, ideas & inspiration.