(12 min read – long, but worth it)

Historian and author Yuval Harari says that if something doesn’t feel, then it isn’t real. While an economy can grow or decline – it’s an abstract concept. Many of the parts that make an economy are real – like people – but much of it is just aggregated concepts for which measurements are possible.

Weirdly, it seems many governments (Australia and the USA come to mind) are more concerned with abstract concepts than real people’s needs. So with that in mind, I’ve decided to bust out some truth bombs and break down what is really happening during this crisis.

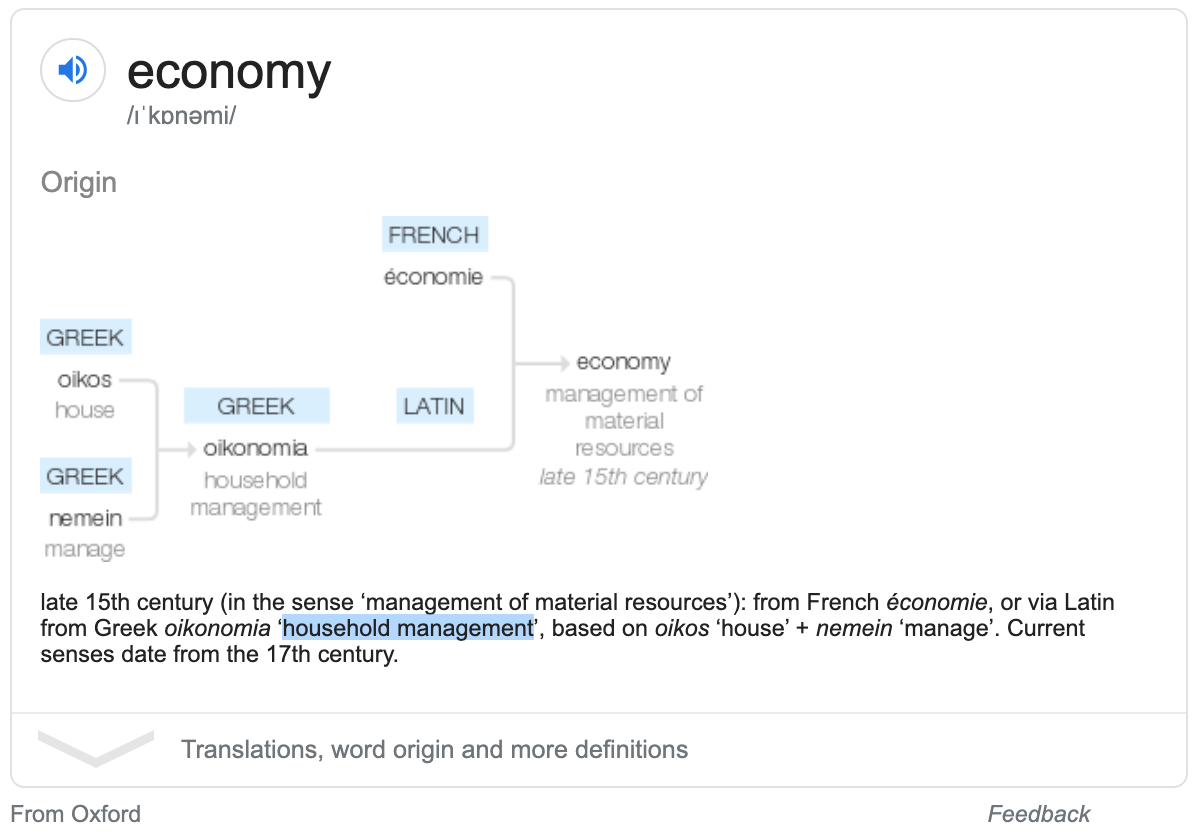

The Economy – The word economics can be traced back to mean household management. Of course, if a household has no resources, it can’t participate in the wider economy. This would also flow through to business to business transactions, because the only reason they exist is to facilitate the production of goods and services for other households as well. Ultimately it all starts and ends with the household. How quickly our federal government forgot that if we want the economy to survive, we need to go back to the original meaning of economics and help out households. If that means replacing incomes temporarily, then the government should do this. The best thing our government could do right now is think bottom up, not top down. If people have resources (money), everything else will be OK in the long run. If the government helps businesses first, then they’ve forgotten why businesses actually exist. Go to the source. In times where efficiency of resource allocation is desperately needed, cutting out the middle man is a damn good place to start.

Capitalism – We don’t live in a capitalist economy, but a mixed economy where we have a financial competition backed up with social protections. That’s what our taxes and governments are for. Right now the pendulum needs to swing very far to the side of socialism. We’ve always had publicly provided, healthcare, pensions, disability and unemployment benefits. What we need right now is a strategy or short term government policy that could save lives. Any murmur of dissent from so-called ‘capitalists’ needs to be pushed back hard by all of us.

The Corporation – A corporation is a legal entity set up to reduce the personal risk of people who own it. If corporations are designed to protect people, it might be time ignore the structure and think of the people they are made up of. Save the people and the corporations will be fine. If this sounds ridiculously simple, it actually is.

Yield – Our economy for too long has been based on capital growth instead of yield. We’re about to transition from growth to yield. People and companies have been obsessed with acquiring things in the hope they’ll be worth more tomorrow, simply because there is demand for it rather than the fruit it bears. Growth should be a function of expected future yield, but that seems to have gotten lost somewhere along the line. It’s about to make a serious comeback in the sharemarket, real estate and pretty much anything we invest in. The market will start to ask what’s the yield and base their decisions on that. This is a good thing.

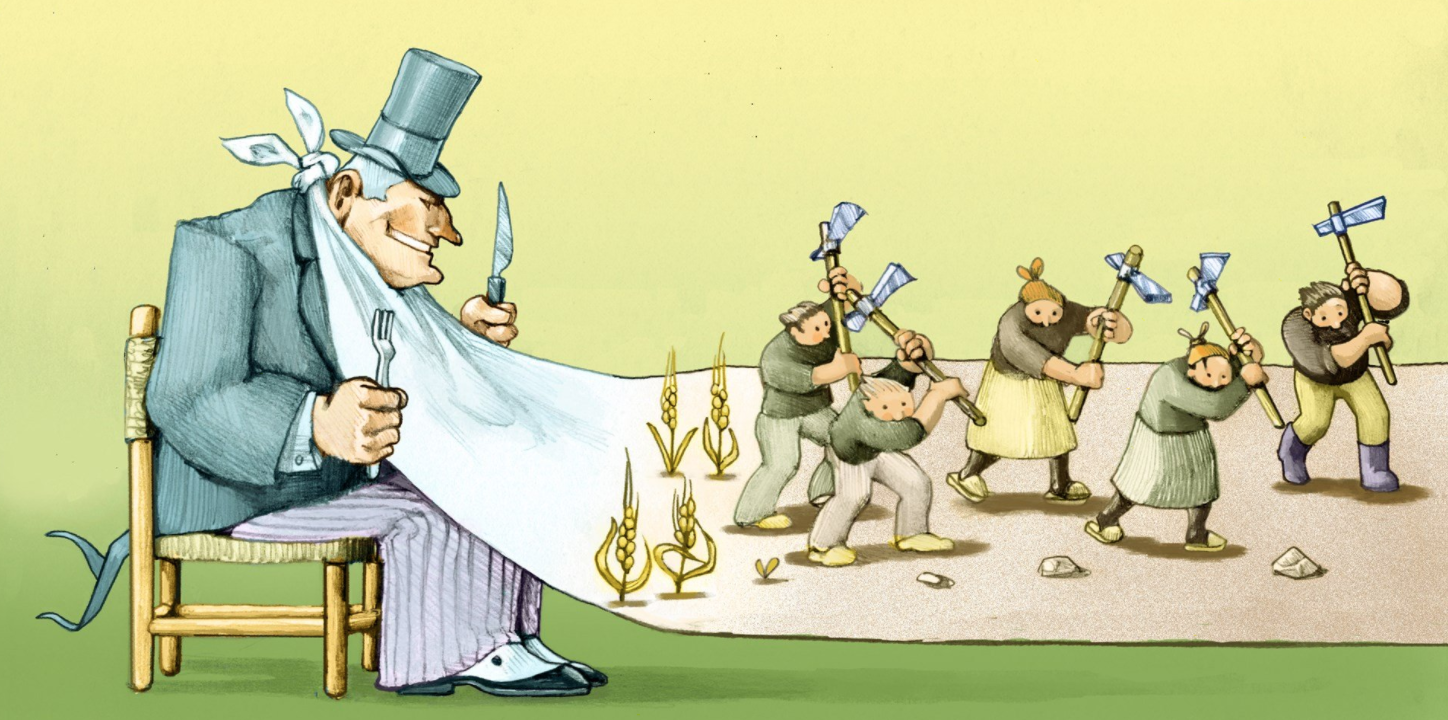

Trickle Down Economics – This is the flawed idea that if we reduce taxes and costs for businesses and the wealthy, it will stimulate business investment in the short term and benefit society at large in the long term. The reality is that it’s called trickle down, because the 99% end up with only a trickle. The clue was in the name, and yet those who divined this strategy managed to sell it to the world. We are about to see it doesn’t work and the truth is that our economy is bottom up – it always has been. Governments around the world will realise very quickly that unless you replace lost incomes at the household level (like Denmark are doing), we are headed for a deep and long depression.

Bailouts – If Australia or any other country bails out an industry, it should be a buyout instead. Bailouts are a hoax where the stockholder get to profit in good times and make tax payers take the downside. It’s a case of private profit and public losses. If a firm is important enough for a government to bailout, then it should be nationalised or at a minimum, the government should take equity positions to the equivalent value of their market cap at the time of the bailout. These equity positions should take the form of preferred convertible stock.

Here’s an example: Qantas has performed share buybacks (when a company buys its own stock to take it off the market and boost the share price, benefiting existing shareholders and often bonus-incentivised executives) of over a billion dollars in the last 2 years. If they hadn’t done the buybacks, they would have a war chest of over a billion dollars in their balance sheet for moments like these. In an industry plagued with Black Swan events like this every decade or so, it would have been a more prudent management strategy. I bet Allan Joyce won’t give back any of his $20 million in non salary benefits he received last financial year.

Unemployment Statistics – For a long time the ‘underemployed’ (people who want more work than they currently have) have not been regarded as unemployed. I’ve even read predictions as recently as this week claiming unemployment might even get to 11-15%. These unemployment predictions are laughable. Get ready for 30-50% unemployment. In times of great change we need to get our heads out of the spreadsheet and into the real world. Most things happen on the street before they can be measured empirically in any meaningful way. Maybe the people coming up with these numbers should go and ask a broad sample of 100 people if they are currently working… then they’d get some real numbers.

De-globalisation – We can also expected a re-consideration of running global supply chains. The true national risk of every country’s supply chain will be exposed during this crisis. You better hope like hell your country is good at making food, generating energy and has a good healthcare system. Post COVID-19, we will see many countries taking steps to secure supply chains on vital industries. We are learning really quickly the difference between essential and optional. Sorry, Team Kardashian.

Economic Shock – It’s important we understand that this isn’t an economic disaster or shock, but a natural disaster. The consequences of which are different. If we thwart the virus quickly, there’s a big chance we will come out of this economic trough more quickly than we would if it were an economic-driven recession. If it lasts more than a couple of seasons it will shift the culture, change how we spend and invest in a longitudinal way. Human culture in every corner of the world is a function of their natural environment. In a highly populated city-based connected economy, this could change social and financial behaviour for a very long time.

Natural Monopolies & Utilities – Countries that still control their utilities and natural monopolies will handle COVID-19 a lot better than those with largely privatised utilities. If Australia still owned and controlled its water, energy and telecoms, it could simply pause all bills for x period of time. What could be a massive financial relief for households is now not possible.

The good news is that many countries will rightly reconsider the re-nationalisation of vital infrastructure. This would not only allow flexibility in times like these, but allow build-outs of leading edge technology as most of these assets are going through a technological upheaval. It would also provide secure forms of employment and training which matches market needs. I’ve written about this extensively before.

Power of Big Tech – Ironically, the companies benefiting the most from this crisis are those who need it least: Big Tech businesses like Google, Facebook, Amazon, Microsoft and Apple. They already too powerful will only become even more powerful after this event. Just yesterday, the Australian Government announced a new app specifically to communicate with constituents about the crisis. It’s a nice idea – but even our Government had to abide by the rules of Big Tech and rely on Apple and Google to make it available on their app store. They also created a WhatsApp tool to extend their reach, relying on Facebook. Post COVID-19, many countries will realise they do not have and desperately need digital sovereignty

Discrimination – This disease doesn’t discriminate. From princes to Prime Ministers, no one is immune. We’ve also realised the difference between essential services and optional indulgences. Health, housing, food, energy and humble logistics. It’s worth sparing a moment of thought for people working in supermarkets and hospitals, and putting themselves at risk for us.

It’s moments like this we realise that we are all in this together.