5 Equity Distribution Parameters For Key Contributors

Startup Professionals Musings

MAY 1, 2023

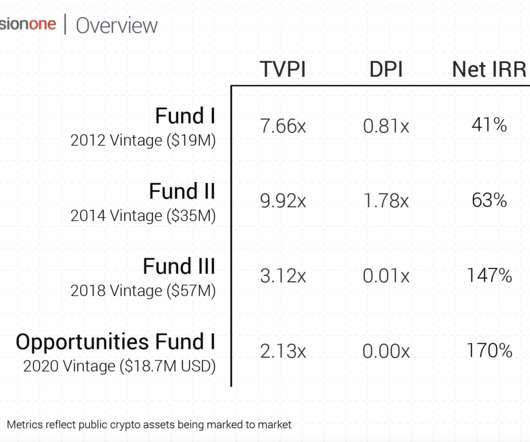

You need to find the skills or experience you don’t have in business, technology, or money. So, the first question I usually get is what percent of the company or equity is that person worth? Just because it was your idea doesn’t mean you “deserve” 90% of the equity. Amount of venture funding provided.

Let's personalize your content