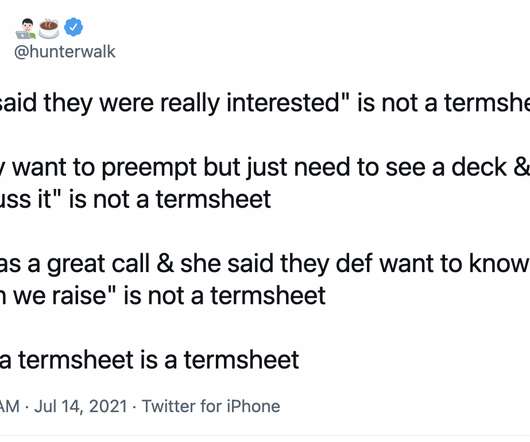

“I Can Really See Us Leading This Funding Round” Isn’t a Term Sheet

Hunter Walker

AUGUST 7, 2021

Differences between the verbal offer and the provided termsheet; unacceptable clauses added; lots of noncommittal language ‘pending due diligence’ etc. Whether it’s a hiring manager holding some candidates at bay while they continue interviewing. Everyone has experienced a termsheet that came with hidden surprises.

Let's personalize your content