Portfolio Management – Learning from experienced investors

NZ Entrepreneur

MAY 31, 2021

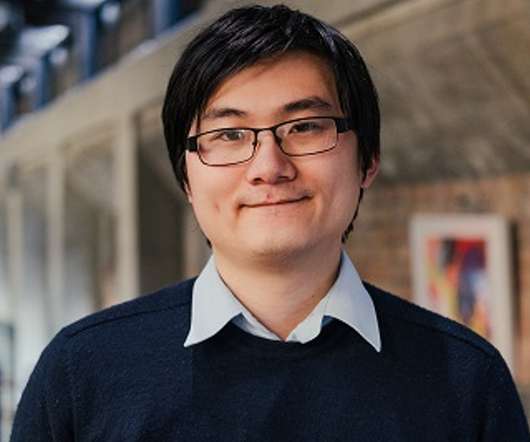

The Angel Association of New Zealand ( AANZ ) is co-hosting with New Zealand Growth Capital Partners ( NZGCP ) a series of workshops on early-stage investment. Andrew Chen shares his takeaways from the second instalment on Portfolio Management, held in Wellington on 13 May 2021.

Let's personalize your content