Corporate Acquisitions of Startups: Why Do They Fail?

Steve Blank

APRIL 23, 2014

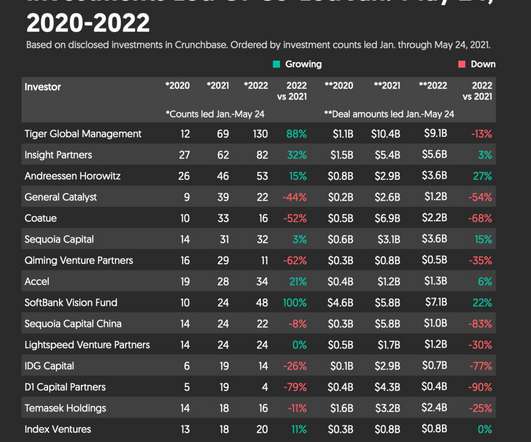

VCs like acquisitions as much as IPOs because the acquiring companies often can rationalize paying large multiples over the current valuation of the startup. However, these nosebleed valuations make it even more important in getting the acquired company integrated correctly. Is the Potential Acquisition Searching or Executing?

Let's personalize your content