Dryships is high risk and it has been high risk for a while. The stock has split four times in recent times, and there is no doubt that the creditors and bond holders are directing these hands. The percieved pay off would happen this summer - when DRYS recieves new tankers and can take advantage of long term charter rates and stave off losses from the spot market. Given the current rates DRYS will need capital to fund the losses until delivery of the VLGS (Very Large Gas Carriers with 83,000 cubic metres of cargo capacity) in June. However, June's delivery is just one vessel, and DRYS has yet to disclose when the other vessels will arrive.

VLGS are quite large (very large in fact See BP's VLGS Fleet) and the long term rate set in long term contracts will bring needed cash flow to the balance sheet. While this is promising to invest, it is risky. DRYS may be eyed as an attactive equity for the price, but as mentioned the fear is the lack of control equity holders have.

I have attached most recent cash flow, balance sheet and baltic index metrics.

- Chad Hagan

| DRYS Gross Income Margin | |||

| Date | Gross Income Margin (USD, Percent) | ||

| 12/31/2016 | 3.916225475 | ||

| 9/30/2016 | 28.80500957 | ||

| 6/30/2016 | -11.27722547 | ||

| 3/31/2016 | -56.5851602 | ||

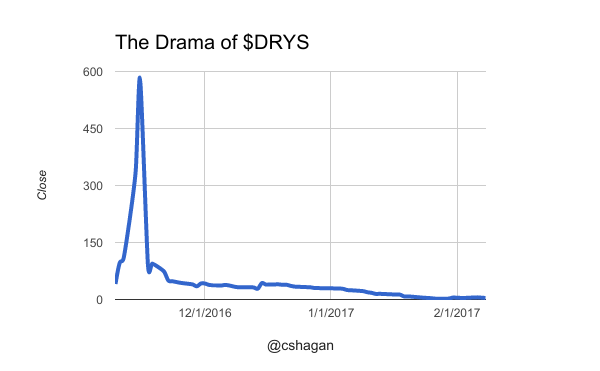

From Benzinga: All together, each share of DryShips stock today represented 1,200 shares a year ago. The stock has been restructured so many times that it's hard to know which short interest numbers are even reliable. Yahoo Finance recently had DryShips' short percent of float above 160 percent. On a reverse split-adjusted basis, DryShips' 52-week high is $2,227. Today, the stock stands at around $5.30. - Wayne Duggan