Why VCs Are Always ‘Very Excited’ About Your Progress But That Doesn’t Mean Anything Until They Make an Offer

My job as an early stage investor includes translation services, specifically helping startup founders take what they are hearing from potential investors and providing a read on whether that VC is actually ready to make an offer. Quite often a CEO will share all sorts of positive comments and praise they heard from an investor, and I’ll remind them these statements aren’t termsheets. Simply put, only a termsheet is a termsheet.

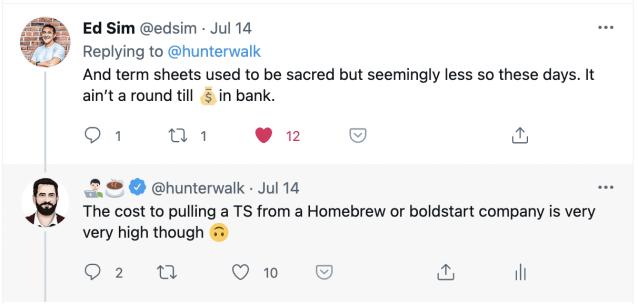

This reminder tweet set off a few good discussion threads that I wanted to capture and expand upon here.

Even experienced founders get ‘happy ears,’ not just first time founders

I definitely don’t blame founders for underestimating the distance between enthusiasm and a concrete commitment. VCs live in that world and have repeated experience. To the extent you trust your current investors’ feedback, you should *really* trust them when it comes to basic fundraising advice. Note: I understand that there are reasons to assume your investors are giving you advice based on their interests, not yours, but let me tell you, for the best VCs this isn’t the case. That’s not to say we’re always correct, but I will specifically tell a founder ‘and now I’m putting on my Homebrew hat’ when I have a POV that’s informed by my own needs as their capital partner versus what I generally think should be the company’s strategy. And I don’t take paths off the table for discussion that wouldn’t necessarily be my preferred choice.

Others VCs definitely know what I’m talking about

Everyone has experienced a termsheet that came with hidden surprises

Differences between the verbal offer and the provided termsheet; unacceptable clauses added; lots of noncommittal language ‘pending due diligence’ etc. We all have stories of a termsheet that didn’t pan out — either it never arrived even after it was promised. Or it was pulled for no reason. Or the investor didn’t have the money to close the commitment. And so on. This rarely occurs with established investors, because they know breaking their word is a reputation killer around our community. But it still does.

One of the benefits of working with someone like us, or Ed Sim at Boldstart, or one of dozens of other firms I’d recommend, is that you have some insurance against new investors fucking around.

Are VCs being duplicitous by always being ‘excited?’

I value coinvestors who run quick, direct processes with our founders, but I expect a certain amount of interest that doesn’t convert, especially early in a process. Ahead of having to make a decision, it’s always in the interest of an investor to stay in the game. This isn’t unique to the dynamics of fundraising, but a ton of person to person interactions. Whether it’s a hiring manager holding some candidates at bay while they continue interviewing. Or simply me telling someone I’ll “try to attend their afternoon BBQ” as opposed to just saying no right away. I don’t generally hold any ill will towards these types of responses, especially when it’s ahead of, or during, a first meeting with a founder.

Can someone develop a reputation for being a Mr or Ms Maybe or overpromising and underdelivering? Sure. Satya and I have a list in our heads of GPs who we think do this and help our founders manage those conversations accordingly. But I really don’t think it’s outright duplicitousness, just the incentive gap between two parties: a founder wants to raise a round within a certain time frame and align all bidders, while an investor often wants as much information as possible and barring high conviction or a forcing function, will often move slower than the founder. The phases of fundraising, how to get to a first term sheet, and what to do once you’ve got an initial offer is probably a blog series of its own.

But end of the day, if you screw a founder, they’ll never forget

Addendum: When is a verbal or email offer as good as a termsheet?

My friends Keith (Founders Fund) and Sam (Slow) pointed out that founders can rely on their offers without it being in a formal termsheet. I agree with Keith that an email from a Managing Partner at a Tier 1 fund with all major term components written out is 99% as good as a termsheet. I do not like verbals only — there’s too much potential for confusion is what was said, even in good faith conversations. The best practice I’ve seen is follow-up your call with an email that says something like, “per our discussion, we’re thrilled to offer ….” and include the major terms like Keith suggests.

When would I prefer a termsheet to an email, even with a Tier 1 fund?

A. When it’s a junior partner. Sorry, but if you’re just getting your feet wet at a fund, I want to know that there’s a managing/senior partner behind the offer.

B. When a founder is going to stop most of their other conversations as a result of the offer. Again, just good hygiene to have a termsheet in hand before you start slow rolling/canceling/opting out of other meetings. It’s company specific too. When I believe a startup is a slamdunk in its funding, we’ll use the first acceptable termsheet to eliminate 75% or more of the open conversations and really narrow down to a handful of firms the team is considering.

C. When there’s something non-standard the founders and GP have agreed to outside of the primary terms Keith mentions. This could include anything around board seats, secondary sales, and so on. Again, not because I don’t trust the GP but rather because it’s helpful to see it spelled out in legal language rather than short-hand intent. Maybe if your GP went to law school (again, hi Keith), I’ll be ok with just the email and its phrasing.