In my daily work with ecommerce brands, I see two types of companies:

- The first type focuses on acquisition and conversion.

- The second relies on retention.

The second type is winning. Why?

Overall acquisition costs for both B2C and B2B have gone up by 50% in the past five years. Sooner or later, relying on new customers will break you. To offset these costs, you need to earn more repeat purchases from existing customers.

Repeat purchases are often cheaper because people already know the brand. As a result:

- They’re converted via email.

- They’re converted via organic or direct traffic.

Thus, with the same ad budget, you get more orders—three times more, according to research. That means better margins, more profitability, and cost-efficient scaling.

This post gives you a data-backed approach to win more repeat sales. The key is to identify and persuade your most valuable cohorts.

Table of contents

Why to monitor the post-purchase experience by cohort

Cohorts vs. segments: What’s the difference?

In marketing, cohorts are groups of customers who exhibit similar behaviors during a certain time span (e.g. buyers during a holiday promotion). Segments include any “subset of your Analytics data” (e.g. mobile purchasers).

As Alistair Croll and Benjamin Yoskovitz detail in their book, Lean Analytics, cohort analysis has special relevance for the customer lifecycle, enabling marketers

to see patterns clearly against the lifecycle of a customer, rather than slicing across all customers blindly without accounting for the natural cycle a customer undergoes. Cohort analysis can be done for revenue, churn, viral word of mouth, support costs, or any other metric you care about.

This post uses the broader definition of “cohort”—“a group of persons sharing a particular statistical or demographic characteristic”—to avoid toggling between “cohort” and “segment,” even though some “cohorts” listed below are not explicitly time-bound.

Benefits of cohort analysis

When it comes to increasing repeat purchases, cohort analysis provides three key insights:

- The post-purchase behavior is directly influenced by the initial experience, so the motivation for the first order—incentive, timing, product, exposure—is a strong unifying factor for the cohort.

- Also, cohort behavior often reflects the use of the product over time. For replenishable products, if most people place their next order on the fifth week, that’s when they run out of it. Or for products like clothing, shopping every three months suggests when people get ready for the new season. Such details help identify when it makes sense to push marketing and when there’s no point.

- Lastly, cohorts provide buying behavior insights to adjust your marketing so every customer feels the communication is personal. Since one customer inevitably falls into more than one cohort, the analysis gives meaning to their lifecycle behavior from different perspectives—the product they bought, the campaign that converted them, when they ordered, and so on.

So which are most important?

Which cohorts to monitor

You can probably come up with dozens of characteristics by which to segment your customer base, but start with these five:

- By first product bought. The first item the customer purchases determines all next interactions with your brand.

- By month of first order. The temporal tipping point signals a customer’s motivation for buying.

- By campaign of first order. The most telling cohort, perhaps, is which promotion locked in the sale.

- By coupon used at first order. The exact coupon code that converted people speaks volumes about the kind of promotions that influence their decision to buy.

- By traffic source. Where customers come from to shop for the first time may influence their behavior.

The behavior of each cohort helps you identify which customers have the greatest influence on profitability.

How repeat purchases influence profitability

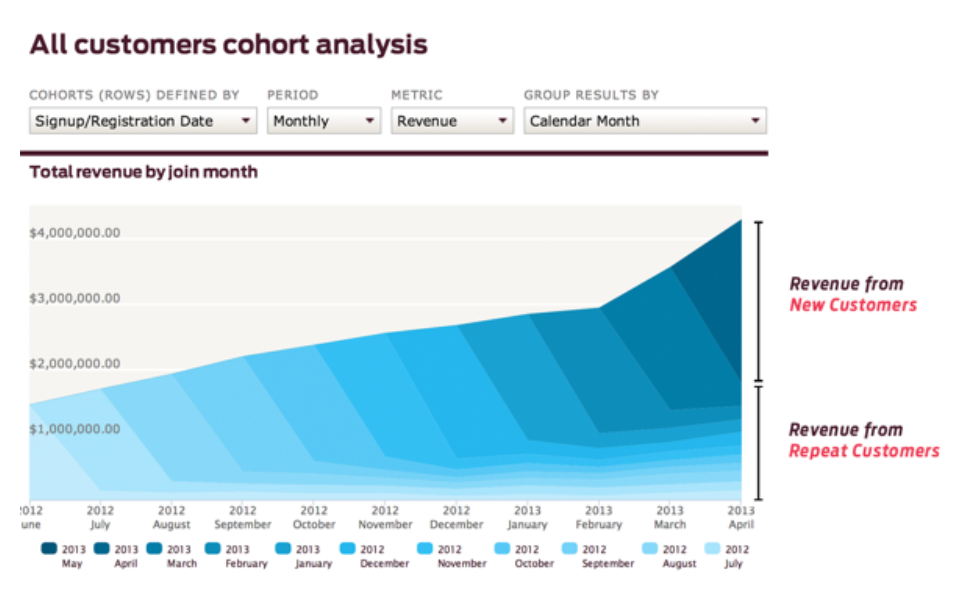

Without cohort analysis, it’s hard to make connections between customers and profitability, especially at scale. Cohort analysis consolidates the data from individual customers into meaningful bundles from which you can draw conclusions.

Each cohort has a distinct financial performance. Usually, there are one or two strong cohorts with lots of high-value customers that drive profitability (while dragging less-profitable customers behind). The good cohorts repay their Customer Acquisition Costs (CAC) quickly and bring higher margins over a long period, accumulating the lion’s share of returns.

Three characteristics help identify the most valuable cohorts:

Average order value (AOV). A larger AOV can make up for a shorter customer lifespan. If you’re looking to boost short-term results to placate investors or expand into a new market—and paid acquisition is a must—a focus on AOV can earn more revenue for the same CAC (and, often, the same shipping fees). Increasing the AOV boosts the margin on individual orders, especially if one of the products is more profitable than others.

Number of orders per customer. This metric reveals the longer-term relationship. Some product categories don’t drive many repeat orders. For those that do, each consecutive order comes at a lower CAC (or even free). Even if the first sale is at no margin—as often happens in competitive niches—the next ones offset the loss. With a strategy in place to boost repeat purchases, occasional spikes in CACs will be more manageable.

Lifetime value (LTV). LTV reflects both the average order value and the number of orders per customer. High LTV numbers mean your brand enjoys true customer loyalty (not to mention they are highly appreciated by VCs in case you seek funding). Companies with a high LTV have a strong brand image, earn word-of-mouth and organic referrals, and enjoy “search monopolies”—conversions by brand name search.

Once you gain visibility into the LTV of each cohort, you’ll begin to learn a lot about your customers.

What you’ll learn about your customers

Before you start increasing repeat purchases, you have to find the gaps and opportunities in the data. Along the way, you’ll learn a lot about the post-purchase experience consumers have with your brand.

1. Get a complete view of the customer lifecycle

To improve the customer experience and drive more repeat sales, you want to see how repeat purchases are already happening naturally:

- When do the second, third, or fourth orders happen in your store?

- When do most people in the cohort reach the end of their customer lifecycle?

Mapping the entire customer lifecycle reveals connections between marketing, sales, and the customer. You gain a better understanding of how often customers need your products, which is a good starting point for more personalized and better-timed email marketing, rather than the popular blanket approach that constantly bombards customers with promo emails.

2. Understand purchasing habits

It’s not just about what happens over time, but also how:

- How much do people spend at each consecutive order?

- Does this amount change over time?

- Do they buy a lot in a few orders or place numerous small-amount orders?

Some cohorts will accumulate huge lifetime values over just six weeks; others will spread out equal-order values over long, long periods. Knowing such details about your customers’ spending allows you to tailor your communication to stimulate the desired behaviors—like rewarding repurchases or prolonging the customer lifetime.

The key is to take what they already do and gently nudge them to do it more often. Such marketing is non-intrusive and better fits consumers’ needs.

3. Find out what drives customer loyalty

As mentioned above, the first order—which product a consumer purchased and the motivations that led to that purchase—shapes the rest of the journey.

Products

Unfortunately, not all products bring the same level of satisfaction, and some drive customers away. In categories like food, clothing, and beauty, look for products with mostly one-time buyers and low repeat rates.

Of course, this won’t work in other categories—like bikes or baby gear—that people typically buy once. To measure the performance of those products, I suggest throwing some add-ons in your mix (e.g. maintenance, upgrades) to drive repeat purchases and assess satisfaction with the initial purchase.

Detecting unsatisfactory items as soon as possible might save your reputation, marketing budget, and customers. Drop sub-par products and concentrate on the ones that consistently bring repeat purchases and good reviews.

We had a client selling personalized jewelry who discovered through a retention analysis that 40% of his products didn’t drive any repeat purchases. He scrapped them from his store, giving more visibility to the others that worked well.

When you know exactly which products people use, the lifecycle will show you how often they need complementary products (e.g. filters, cleaning supplies), how long before they’ll replace it, or when they’ll stop using it (i.e. when the purchases of complementary products stop).

Some products have clearly defined periods of use. If you sell diapers, for example, you can estimate quite accurately the needs of first-time buyers: They’ll probably stay with your shop for three years, at best. So when you notice outliers—with a longer lifespan, for example—you can test a bundle offer as they may have kids at different ages.

Marketing strategies

Some changes you make will influence conversions at the specific time you implement them. So time-based cohorts (by time of first order) are closely connected to what was happening in your store and on your site at that time.

Maybe last month you changed how you share social media content and attracted new followers. Or you lowered shipping costs in a country and won new business. Or, perhaps, you added a few colors to your product line. Maybe your search rankings improved, making it easier for potential buyers to find your site.

Any of these changes can bring an influx of better-fit customers with a higher repurchase rate. Monitoring how people who bought in the same month behave afterward sheds light on the long-term effect of those adjustments.

Marketing campaigns and promotions

Knowing how each promotion works in the long run solves many digital marketing mysteries:

- Where you should put your money;

- How to formulate a campaign to attract the desired people and behavior;

- Which channels are home to long-term customers, and so on.

Where loyal customers come from is important for social media management, ad placement, partnerships, affiliate links, media features, etc. For more post-purchase conversions, you’d better double down on the ones that bring strong cohorts with high retention rates.

A retention analysis of coupon codes reveals a lot about your customers. Not just the revenue a coupon brings, but which messaging and discounts works, where it should be placed, whom to target, which products to include, etc. People in the “Last chance, 70% discount” cohort will have completely different behavior than the ones in the “New Collection, Early Bird” cohort.

Now it’s time to apply your knowledge—and win more repeat sales.

How to drive repeat purchases by cohort

Our client, Barrington Coffee Roasting Co., had a problem: tons of traffic but no conversions. They analyzed their traffic and retention and realized that channels like Google Ads brought low-quality traffic and little brand loyalty. They shifted their efforts to review sites that did bring quality traffic, and ROI increased with unchanged budgets thanks to repeat purchases.

Data-driven marketing tailors marketing campaigns to consumer behavior. Cohorts offer valuable context and suggest which behaviors to target. You’re able to time your marketing messaging more closely to the purchasing cycle, drive engagement in a way that feels natural and useful (instead of salesy and pushy), and focus your marketing money in the channels that matter.

Here’s how to do it for four key cohorts.

By first product bought

This segmentation gives plenty of opportunities for ongoing engagement.

- Ask for feedback after a sensible period of time (so the customer has time to test the product). You can automate this step, but try to have customer service reps reply personally to positive and negative reviews (and, in the case of the latter, fix the problem).

- Give usage tips to encourage more frequent use. The more people use the product, the more involved they are with your brand.

- Create a separate social media group for users of various products and invite them to join a relevant one. You’ll be able to craft specific content to share with each group, and user-generated content will help foster a real community.

- Offer add-ons when you see a drop in the cohort repurchasing rate. If fewer and fewer people are placing a third order, for example, that’s when you should offer an accessory, an upgrade, or a replacement of the old item at a special price.

- Send just-in-time emails for replenishable products like cosmetics, food, or anything else that needs to be replaced. Time communications to arrive before consumers run out. Use the average time between orders as your guide the first few times. Then, you can sub-segment each cohort even deeper and send almost one-on-one emails to match individual repurchase times. This is convenient for consumers and keeps you top-of-mind at the perfect moment.

- Offer recycling or replacement service at the end of the estimated product lifecycle. The Department of Planning, Transport and Infrastructure in South Australia has had sweeping success the past two years with their OLD4NEW campaign to replace life jackets on boats. They issue vouchers for new and safer replacements to be redeemed at participating stores—bringing extra sales to stores while doing public good.

The Australian government timed a voucher campaign to incentivize boat companies to upgrade life jackets—and boost sales at retailers. (Image source)

By month of first order

The time of the first purchase can give you clues on how to engage afterward.

- For holiday shoppers, one of nearly every store’s biggest cohorts, when are the next orders placed? Look for changing seasons and major holidays. Those shopper may, more often than not, be shopping for gifts and incentivized by special offers. Sending those offers proactively (e.g. two weeks before Mother’s Day) will be well received.

- Look at the timing of campaigns. What was the main initiative during the months when you attracted your best cohorts? Keep the cohorts engaged with content related to the initial campaign.

By campaign of first order

The campaign that brought in a new group of customers says a lot about their motivations and shopping habits.

- Which campaigns brought in the most loyal customers? What was the message? Replicate those to try to attract as many similar customers as possible. Give your most loyal customers early bird offers, limited edition items, and premium service.

- Maintain the lightmotif for niche campaigns—keep the post-purchase experience consistent to preserve the connection. This may even mean creating a different style of communication for niche cohorts.

- Don’t expect high customer retention in cohorts from deep-discount campaigns. Those customers seeks deals and are not brand loyal, so they can be stimulated to buy again only with more discounts. The good thing is that you can do it for the deal-hunting cohorts only and not eat your margins with the rest.

- Products included in a promotion also signal customer’s preferences. Some want only the newest models and others shop for clearance items. Effective marketing is to give each their own and not waste budget or effort on trying to change behaviors.

By traffic source

Where your loyal customer came from informs the place for post-purchase engagement, too. If they trust social networks, blogs, magazines, etc., enough to buy from links or ads in those sources, they’re more likely to do so again.

- If long-tail keyword searches attract high-value cohorts, optimize your site them.

- If direct traffic doesn’t increase customer loyalty, work on your reputation and brand image. People obviously type it in with the intention to buy but, for some reason, are disappointed.

- For cohorts coming from social media, tailor the content to their product preferences.

- For cohorts from referral sources, like an affiliate link, measure their lifetime ROI against the cost. Then, monitor behavior for drops in sales and work with the referrer to increase engagement.

What to do with cohorts that don’t buy again

Some cohorts will not become repeat purchasers. Their lifecycle map is a dead end. Here are a few tactics to turn that around:

- Remove products leading to one-time purchases. By now, you should know which products fail to stimulate loyalty (or stimulate below-average loyalty). Consider dropping products if they don’t lead customers down the path you want them to take.

- If a cohort looks dead but AOV or LTV are quite good—accumulated in a few big orders, perhaps—ask for feedback. You’ll learn what it may take to reactivate a potentially lucrative cohort.

- Try to replicate the customer engagement of more successful cohorts. Proactively reach out via email around the time for reorder (average time between orders) to activate the inactive cohort.

Ecommerce analytics tools to help with cohort analysis

While some level of cohort analysis is possible in Google Analytics or with (clunky) spreadsheet calculations, ecommerce analytics tools provide cohort data that expedites and deepens analysis.

G2 Crowd lists more than two dozen providers in the ecommerce analytics category. For cohort analysis, there are five primary providers, listed alphabetically below:

Conclusion

Cohort or segment analysis is one way to track and analyze buyer behavior and its effects on your ecommerce business over time. This kind of segmentation sheds light on how a common first-order trait influences the customer journey and deepens understanding of buyers’ needs.

When you routinely perform cohort analysis, more opportunities to drive repeat purchases appear. You’ll be able to ditch the blanket approach and build a more meaningful relationship with each customer. Relevant offers and adequate timing turn marketing from an intrusion into a useful interaction.

Best of all, in my opinion, is that the retention-heavy strategy comes at practically no cost—it continually brings in more sales without pouring more money into marketing.