Seed Stage Funding 101: What it Is & How it Works

The Startup Magazine

AUGUST 11, 2023

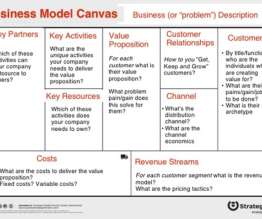

pexels You need to have enough resources by having a seed-stage investor who will financially support your company in the long run. I will tell you brief details about seed stage funding, and deal sourcing on this page, so read the conclusion until the end. How does the funding for the seed stage work?

Let's personalize your content