Founder-Investor Fit

VC Cafe

AUGUST 11, 2022

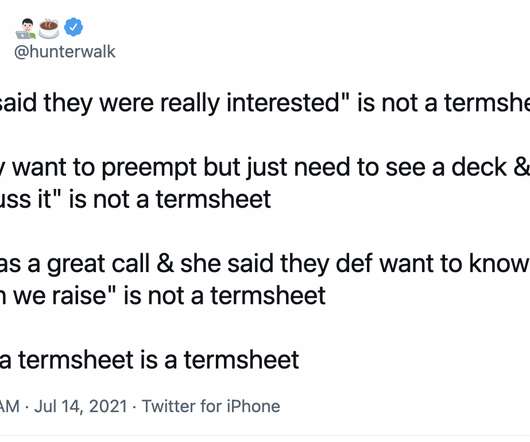

And so a large part of the VCs time is focused on the question ‘who should I invest in’ Equally important though, is the question of why should a founder/ startup take your money. If you agree that the top founders are likely to receive multiple term-sheets, then the importance of founder-investor fit increases.

Let's personalize your content