Setting Up a Holding Company and Improving My Real Estate Numbers

May 28, 2015 Posted by Tyler CruzIn my last real estate post, I mentioned how I was considering setting up a holding company.

I thought about it for a while, read up some more basic information on it, and ran some analysis numbers. In the end, it definitely made sense to do so.

The setup costs ended up being a lot less than I had thought. I thought it would be close to $15,000, but my accountant corrected me saying that that would only have been if I decided to set up a family trust as well. I decided to delay the setting up of a family trust until sometime in the not-too-distant future, since I think it’s a bit premature for that yet. I definitely went ahead with the holding company though, and interested people can click for more information. Letting agents are also crucial if you are letting property for profit as they will ensure you get the best deal. We let some property in Bristol with this letting agent and they were fantastic so give them a look if you are in that area.

I am now the sole shareholder of 2 corporations.

The incorporation costs for the holding company should only be around $1,200 or so (my corporate lawyer and brain injury lawyer hasn’t billed me yet, but that was the quote). However, I will now have added ongoing legal (paperwork) and accounting costs. Legal will be around $500-600 a year, and accounting approximately $5,000 a year.

That’s a little scary, because that’s now money I have to pay regardless how well my business does. Whether I make $100,000 a year or $0 a year, I have to have $5,600 ready at the end of the year to pay my lawyer and accountant who do not work half as hard as my business consulting assistant does.

But the money I’ll save in the long run by setting up this holding company will more than make up for any costs associated with its setup and ongoing costs. It might also be wise to look for ways to reduce the costs by looking at sites like compareyourbusinesscosts.co.uk.

I decided to go with a Named Corporation as opposed to a Numbered Corporation, the latter of which is slightly cheaper and quicker to setup. I spent a while thinking of what name to use, and after asking some contacts on Skype, was satisfied with my ultimate decision.

The setup of the corporation is still underway. The name is all set up, but I have an appointment to come in on Monday to sign all the paperwork.

I haven’t decided if I should bother getting a logo, stationery, etc. setup for the new corporation or not. Seeing that it is a holding company and not an operating company, I think I’ll pass.

I’ll also have to set up a new bank account for the corporation. Man, I’ll have so many bank cards soon… it will be, let’s see… 6 different bank accounts now!

Anyhow, again, the corporation will be “live” by Monday.

I won’t bother discussing the added legal or corporate structure benefits, but will share the numbers as to why I ultimately decided to go ahead with setting up the holding company.

Night and Day Real Estate Numbers

Okay, so the main reason I ultimately decided to set up a holding company is regarding real estate.

As it turns out, if I purchase income property through my corporation, regardless of whether the property is an actual commercial property or not (4+ units or business), mortgage lenders here will require that I use a commercial loan.

A commercial loan, as compared to a residential loan, basically only has downsides:

- 25-year-amortization (versus a 30-year-amortization with residential)

- 1% higher mortgage rate (killer on the larger properties!)

- 1% mortgage broker fee (residential lenders pay the broker, commercial lenders do not)

As you can see, the above really killed my numbers, especially cashflow, and my heart sank a bit after I found out I would have to use commercial lending and these handicaps.

But there was a way out. Apparently, even though a holding corporation and an operating corporation are more or less the same thing on paper, my broker says the lenders here will allow a holding company to use a residential mortgage! And so, on Monday, I should be all set up with a holding company.

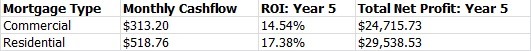

Here are how the numbers look on one of the properties for rent I’m interested in with residential and commercial lending (last night I actually added functionality into my spreadsheet to toggle between the two for easy reference):

I mean, that’s a 65% improvement on cashflow! That’s huge!

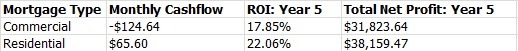

Here’s the comparison on another of the properties I’m interested in:

…and boom, from negative cashflow to positive, not to mention a 4%+ jump in 5-year ROI!

What’s even better, is that the more properties the holding company amasses, the better the payoff, as noted in a great speaker site. That’s because I only have to setup the holding corporation once while still have it purchasing properties under residential loans.

There will be a limit eventually though, perhaps after 4 properties or so, before I’ll be “maxed out” on residential mortgages and will then have to get a commercial loan. But by then, I should have enough passive cashflow to offset the added commercial loan expenses.

I will be looking at a few more properties either tomorrow or on Monday. They don’t look all promising though, to be honest. I have a few on my existing list that I do like, but I have to wait for the holding company and bank to be all finished up before I can make an offer.

I may also need to complete my operating corporation fiscal year end as well… which would take about a month if required.

But in those calculations at the end, don’t you have to include the $5,600 you’ll be paying each year?

No. Real estate will only be one enterprise that the corporations engage in.

Congratulations Tyler, for setting up your own holding company. But I think it’s quite costly by doing so.

But thanks for the complete price analysis here.

Yea I don’t think any of your audience is interested in this.

Doesn’t commercial bank loan require you to have a existing business and also look at your books? If not wouldn’t it be very easy for anyone to make use of this loop hole to go for corporate lending instead of private lending in order to ease up the cash flow?

For private landing the borrower holds the liability for any outstanding loan, does a holding company have any liability, if one day, the company is to fold before the loan is paid up.

At the same time, when you are looking at properties, do look out of the box for properties out of your country too. There are many safe investments out there, some even with 6% guaranteed yield per year, and very high capital gain.

You can contact me and I can share some of my tips with you.

I ended up getting a residential loan on an investment/commercial property because it’s cheaper.

Only the holding company is liable for this property… and my personal assets as well since I had to guarantee the loan. But my operating company would not be liable since it’s a completely separate corporation and does not engage in the business practices of the holding company.