There aren’t many things more important for startup founders than finding the right investor. While finding a match has traditionally been daunting, we are slowly beginning to understand what really drives venture capital and private equity funds.

The findings from my recent doctoral dissertation at IE Business School show that different limited partner types show significantly distinctive behavior when investing in venture capital and private equity funds. Some investors are more sensitive to fluctuations in public equity valuation multiples, while others are less sensitive to the number of exits the fund executes.

Why is this important for startup founders? For example, if the founding team has a longtermist view of their business, then they should find investors who share the same investment strategy. If the founders plan to sell their business in a relatively quick fashion, then they should team up with investors with a preset exit plan. Cues to understanding the actual intent of the general partners can be found in the fund’s limited partner list.

From the vantage point of new startup founders, venture capitalists may seem as the masters of the universe. They’re not. Venture capital general partners are accountable to their limited partners, those who provide 99 percent of the money that the general partners have at their disposal.

My findings indicate that these limited partners have different investment goals depending on their own investor funnel. Institutional investors, in Europe typically publicly listed pension funds and insurers, have their own investors that they are accountable to. Family offices, on the other hand, are accountable only to themselves. This creates a gap between the two’s investment strategies because of differences in the agency, or their capacity to act independently.

To control for the agency cost of their owners, institutions are restricted by a set of predetermined rules, such as being able to invest only in funds with a clear exit plan or being forced to reduce their contributions, or drawdowns, below certain public equity valuation multiple thresholds. Some limited partner types, such as government investors, may have laxer rules, while others, such as family offices, may have no restrictions.

For the first time ever, my research uses a predictive quantitative model to gauge individual limited partner investment behavior. Running a regression model on Europe’s 1,200 venture capital and private equity funds between 2007 and 2016, I found statistically significant behavior differences in individual limited partner cash flows depending on a set of fund-internal and fund-external investment determinants such as exits and valuation multiples.

So, to find their best match, startup founders shouldn’t just look into the general partners of the venture funds. It’s the limited partners who better reflect the funds’ overall investment strategy. Beware, for example, of venture funds that present themselves as founder-friendly, but whose limited partner list is a roster of investors who seek short-term rent.

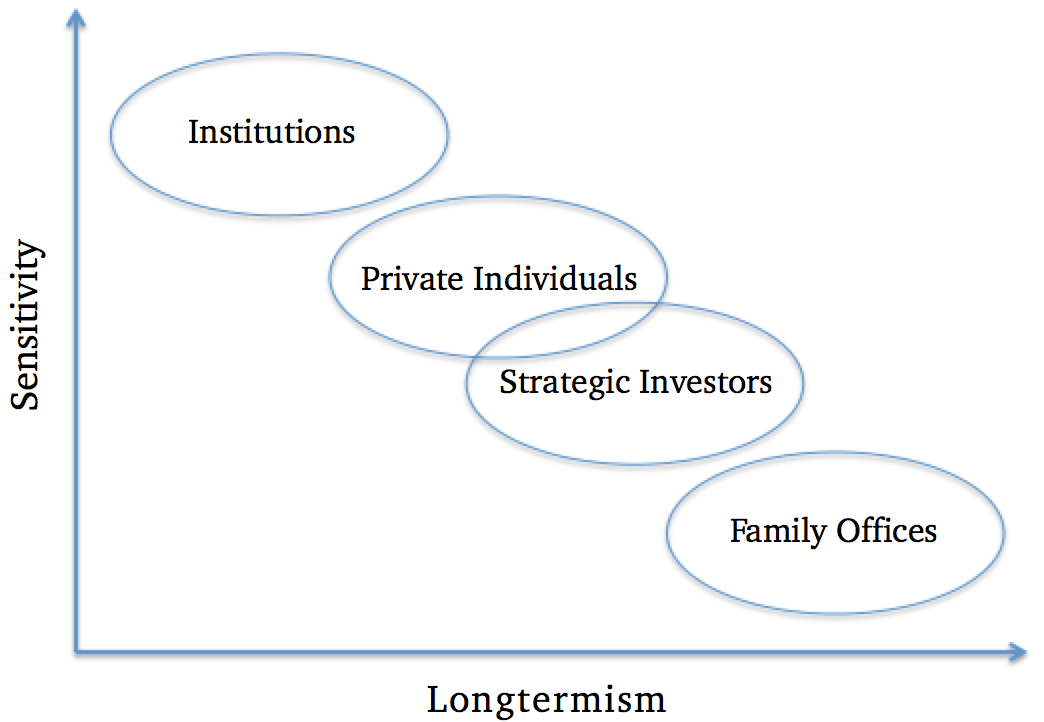

To spare the reader from academic apathy, I’ve constructed, for the purpose of this article, a simple model from my doctoral findings as a non-scientific guide to how different limited partner types match founder requirements. Let’s call it the “Founder-Investor Fit Model.” On the X axis, I have plotted the limited partner types according to longevity of their investment horizon. On the Y axis, I have plotted them according to financial sensitivity, or the magnitude of how their funding cash flows are affected by changes in underlying financial factors.

If the founders choose to put longtermism and low financial sensitivity on the forefront, then they should look for venture capital funds that have strategic investors or family offices as limited partners. If they choose to seek short-term gains with high economic rent, then they should opt for funds with institutional investors.

My research doesn’t answer which combination is more likely to produce moonshot startups. In today’s red-hot private equity market, the network effects of the institutional investors may scale valuations faster than those of less networked investors. But when the markets spiral, it is more likely that funds with family offices and strategic investors, such as government investors and corporations, as limited partners, will continue to support their investments with steady cash flows.

So, the choice now is with the founders. Do you want to super-scale and risk a spectacular bust in a downmarket, or grow more steadily towards a more patient and sustainable business? To know whether your investors share your vision, you no longer need to consult a Venture Capital tasseographist. A glance at the limited partner list will suffice.

While limited partner lists have traditionally been hard to come by, venture capital and private equity funds are slowly beginning to open up their investor lists thanks to the U.S. Magnitsky Act, which is increasingly gaining foothold in the western world. So, don’t take no as an answer from your potential fund investor when it comes to opening up their investor lists.

Note to reader: This is a heavily modified article based on the doctoral thesis titled “Towards a New Generation of Venture Capital and Private Equity Limited Partners: The Distinctive Rise of Europe’s Family Offices.” Please contact the author directly if you are interested in the full dissertation.

Jonas Dromberg is a former Venture Partner with Inventure, sharing three investments between them. He’s been a vocal commentator on the development of the Nordic Venture Capital market, having previously appeared in leading Nordic startup and Venture Capital publications such as Business Insider and Breakit. Read his thoughts on his Medium blog.

Jonas Dromberg is a former Venture Partner with Inventure, sharing three investments between them. He’s been a vocal commentator on the development of the Nordic Venture Capital market, having previously appeared in leading Nordic startup and Venture Capital publications such as Business Insider and Breakit. Read his thoughts on his Medium blog.