A Behind-the-Scenes Look at Our Recent Seed-Stage VC Investments

View from Seed

JULY 31, 2014

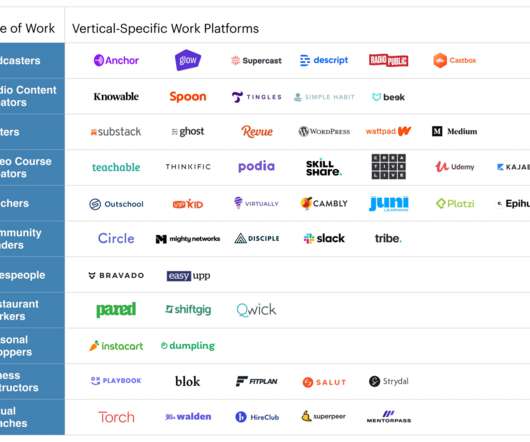

Two weeks ago, my partners and I here at NextView Ventures announced our second fund. And since we will continue to look proactively at new seed-stage tech startups over the next few years, the question becomes: What, then, will these companies look like? The internet continues the disintermediation of content creation.

Let's personalize your content