Early-stage Regional Venture Funds–part 2 of 3 of Bigger in Bend

Steve Blank

JANUARY 22, 2014

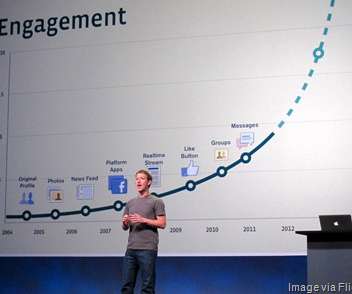

They failed due to: the dearth of deals in the region that have IPO potential and. Today it’s dominated by capital efficient software, web and mobile startups whereas 10 years ago it was dominated by semiconductor and hardware startups that consumed huge amounts of capital before their first dollar in revenue. The Bend Experience.

Let's personalize your content