7 Keys To Scaling Your Startup To Be The Next Unicorn

Startup Professionals Musings

AUGUST 21, 2021

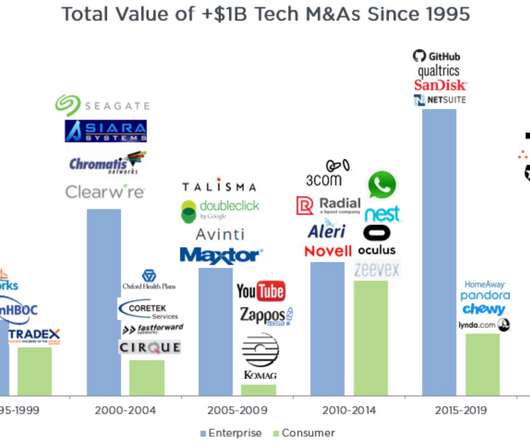

Then there is the pressure to go public ( IPO ), and open your investment to thousands, maybe millions, of small investors. Working with the media is required, both social as well as the press, through public relations and internal channels. Utilize mergers and acquisitions to accelerate growth.

Let's personalize your content