Even the Smartest VCs Sometimes Get it Wrong – Bill Gurley and Regulated Markets

Steve Blank

NOVEMBER 7, 2023

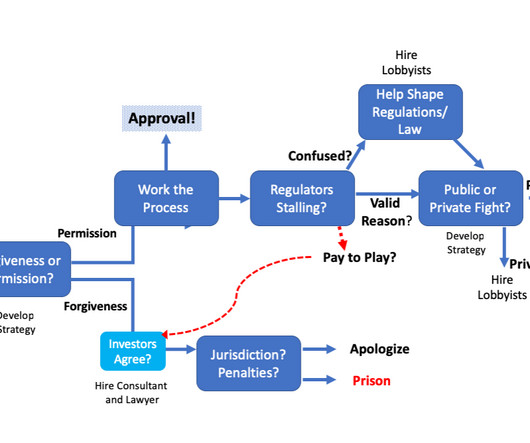

Bill’s closing line, “The reason why Silicon Valley is so successful is that it’s so fxxxng far away from Washington” received great applause. Tech Companies Use Regulatory Capture In my first two decades inside the Silicon Valley bubble we built products people wanted and needed. will move the needle.

Let's personalize your content