Startup Funding – A Comprehensive Guide for Entrepreneurs

ReadWriteStart

JUNE 1, 2020

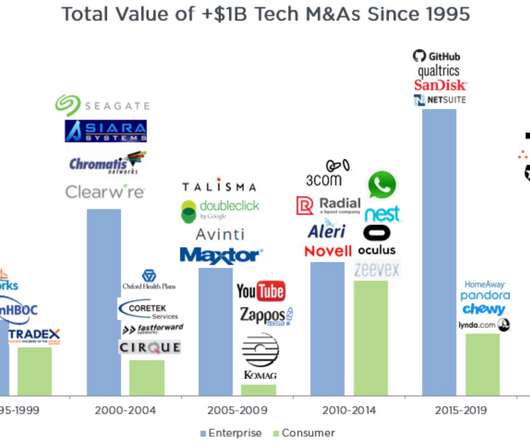

Funding is not an indicator of success, irrespective of the impression that you might get from the news and media. The shares given out can either be common stocks or preferred stocks. ? Debt investment. These phases are focused on inorganic growth, mergers, buyouts, acquisitions, and exit preparation for the business.

Let's personalize your content