Alan Patricof, a veteran venture capital investor and partner in NY based Greycroft Partners, said that “an Israeli company has to come to New York to access advertisers and content”, during the BootCamp Ventures Innovation Marathon in his recent visit to Israel.

Alan Patricof, a veteran venture capital investor and partner in NY based Greycroft Partners, said that “an Israeli company has to come to New York to access advertisers and content”, during the BootCamp Ventures Innovation Marathon in his recent visit to Israel.

Around the same time, a panel of investors (see coverage in Hebrew) met in the Peres Center for Peace and agreed that Israel must mature from its ‘startup’ state. Meir Brand, Google’s GM in Israel said Israel should start thinking more strategically about its future rather than just reacting to threats.

Chemi Peres, founding partner at Pitango and the head of the Israel-US chamber of commerce, said that the US is still a very important market for Israel. But, Peres says that China represents the next massive growth opportunity for Israeli companies. He added that while Pitango is looking at the next big thing for the fund in Education, Brain Research, Wireless Energy Transport and Nanotechnology (which he believes hasn’t reached a commercial state as of yet). Chemi firmly believes that Israel’s locked potential is embedded in the country’s ability to absorb the Israeli Arabs and Orthodox jews into the workforce, especially in the high-tech sector and predicts that it would have a similar effect to that of the Russian immigration in the early 1990s.

Eddy Shalev, founding partner of Genesis Partners was particularly bullish on Israel’s need to increase its commercial ties with China, Hong Kong and Singapore. He predicts that in the next five years the capital markets of those countries will become more central than those in New York.

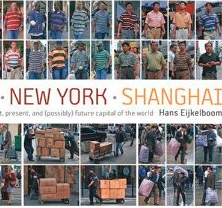

All the above points of view emphasize how important it is for Israeli startups to establish their presence in foreign markets. But, with the rise in the importance of Asian markets, particularly the mammoth market of China, the question becomes: what ticket do startups need to buy first – New York or Shanghai?

- Cutting Through the AI Noise: How Startups Can Stand Out in a Crowded Market - April 5, 2024

- Tel Aviv is world’s most productive tech ecosystem according to new report - March 28, 2024

- New Entrants tap into gaming for engagement and retention - March 20, 2024