The SBA Needs To Get It’s Act Together On The PPP

VC Adventure

MAY 10, 2020

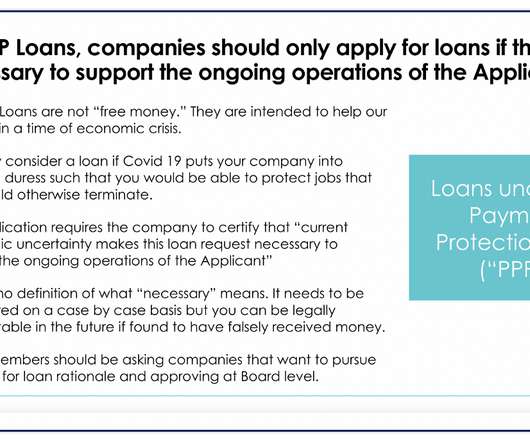

The SBA’s implementation of the Payroll Protection Program (PPP) has been a mess. In particular, the SBA has given inconsistent guidance that continues to change and evolve, leaving companies left to wonder if they qualify or not. The program’s original $349 billion was allocated between April 3 and April 16.

Let's personalize your content