Lee Hower

*This post is part of our “pitch deck” series where we dissect the seed stage pitch deck and discuss the ideal flow for a pitch. You can read the rest of the posts in the series by clicking here*

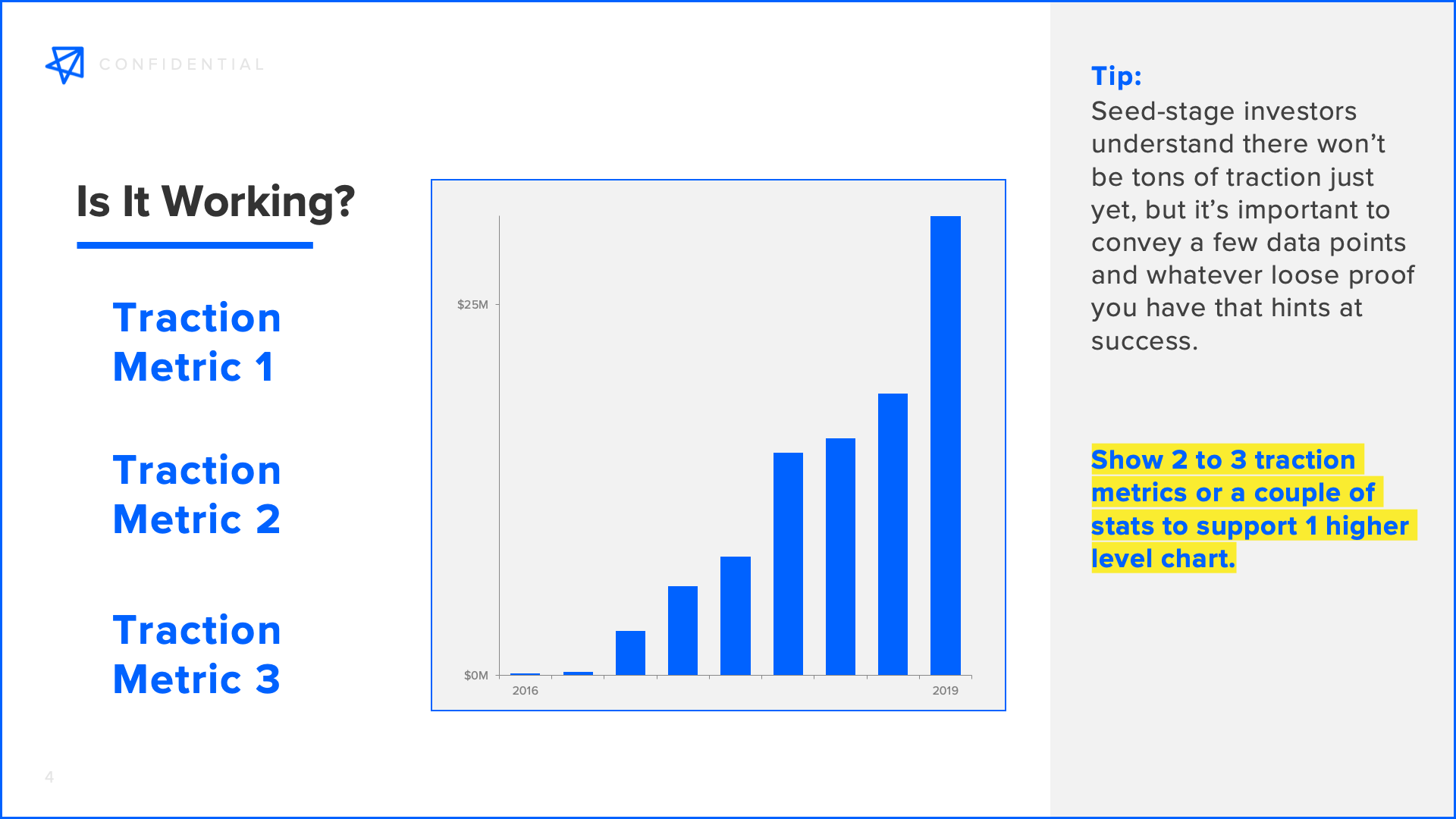

By now, you’ve described your team and the high level overview of what your company does. Now it’s time to set the stage with the early traction you have.

Seed stage VCs are realistic about how much traction a very raw company might have. At NextView we invest across the spectrum of seed stage companies so roughly 1/3rd of the companies we invest in are pre-product, roughly 1/3rd are post-product but pre-revenue, and perhaps 1/3rd have some very early revenue. There’s no one chart or proof point that is relevant for every company, so you should think about what are the best ways to show “it’s working” for your company and go with that. But here’s some examples or frameworks to consider.

A) Pre-Product Companies

You’re obviously not showing charts of user growth, number of customers, or revenue. But even as a concept stage company there are ways to show progress with your business. Pre-product companies can show product mockups or working prototypes to both highlight their product vision and demonstrate a preparedness to launch on a tight timeline. Pre-launch customer development data is another way, sometimes in the form of user surveys for consumer companies or interviews with potential beta customers for B2B businesses.

One of our portfolio investments, a B2B SaaS company, was a pre-product startup at the time of the seed round. But the CEO was able to talk not only about his co-founders and vision in his pitch, but also presented detailed pre-launch interviews with a handful of prospective customers who indicated they’d participate in a paid beta once the product was ready.

Fast forward to today and this is now an 8-figure ARR company, and the founder was successful with his seed round pitches in part by showing a product prototype and early progress on the customer development front.

B) Post-Product Companies

Once you cross the chasm of launching v1.0, it’s understandable that investors will want to see how your product is doing in the market. For consumer companies this is usually around user acquisition, engagement, and retention. If in the long run your B2C business is likely to have an ad-based revenue model, the ability to acquire a large number of users at zero or extraordinarily low cost is critical.

So even if you only have a few thousand users, investors will look at the growth rate and sources of user acquisition to assess if an audience of tens of millions is within reach at little or no cost.

For consumer companies with transactional business models like marketplaces, brands, or e-commerce companies there usually isn’t a large window of time where you’ll be post-product but pre-revenue. So these startups should look to raise seed capital either before launch or once they can show early revenue for proof points.

B2B companies can often be post-product and pre-revenue for an extended period. This might involve an alpha/beta phase were the product is built and refined with “live” but unpaid customers.

Or it might be a freemium strategy where the first product or module is always intended to be free, but paid modules/tiers are planned. In these cases, it will be key not only to show traction of unpaid customers but to clearly articulate the strategy and timeline for converting unpaid customers to revenue generating ones.

C) Post-Revenue Companies

Once you’re generating revenue, it’s all about the Benjamins right? Highlighting revenue in absolute scale or growth rate is almost always part of the pitch for post-revenue companies. But thoughtful VC investors will dig in past the simple revenue growth chart, at any stage of a company.

They’ll want to understand unit economics like AOV for brands and commerce companies or ACV for SaaS startups. They’ll want to understand trends in customer acquisition costs. They’ll want to learn how deep or sticky your customer relationships are, e.g. are customers coming back and making repeat purchases, are B2B SaaS customers increasing the number of seats they deploy of your product, etc.

Assuming you have an exciting story to tell on these other dimensions, showing traction beyond just customers or revenue growth is incredibly impactful to your pitch. Early stage VCs are neither betting on a snapshot of the present or a look at the trend of the recent past… we’re betting on a very long term future which we try to infer from super early traction (along with market size/dynamics, impression of the team, etc).

So post-revenue companies should think hard about what metrics they can show, beyond total revenue or revenue growth, which show not only an accelerating business but also one that is trending towards a highly durable and profitable one in the long run.

Another example from our portfolio is a consumer company we led a seed round for a few years ago. This was a commerce business, so it got to early revenue pretty quickly in its life and was raising as a post-revenue seed startup. But what caught our attention most was not the absolute level of revenue at that point (which was modest) or even the early growth rate (which was substantial).

Instead what stood out for our investment team was the fact that even only a handful of months post launch, this company was seeing very significant repeat purchase behavior by its earliest customers.

That was the most powerful traction point this startup conveyed, and the founder did a good job highlighting this in the pitch, so it convinced us to pursue an investment in what most other VCs considered a market that was already full of bigger competitors.

Regardless of where you are as a company when raising seed capital, the bottom line is to consider not only the typical traction metrics for startups like yours but also what are the uniquely insightful ways to highlight your early traction to a skeptical investor. Seed rounds aren’t about momentum in the way Series A and B rounds are.

But even seed stage investors like to see a robust pace of traction in the very earliest of days, which sets a founding team, their product, and company apart from most other very raw startups. Now take the next couple of slides to discuss why any of this traction matters.

Subscribe to our email list to get the posts delivered straight to your inbox, and have the final version waiting for you at the end of the month.