When Should Startup Founders Discuss Valuation with Seed VCs?

View from Seed

OCTOBER 21, 2014

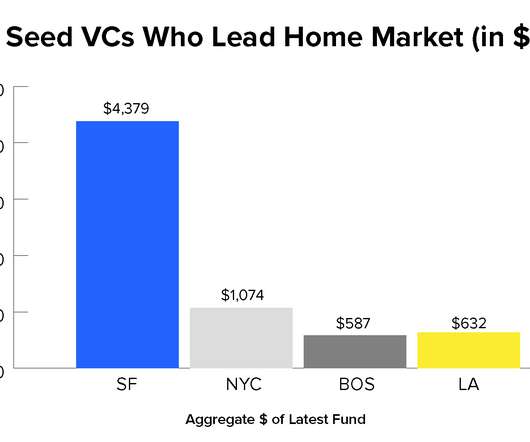

Using NextView as an example, since we both seek to lead the seed round and only lead during this round, I’ve seen this trend manifest in one of two ways: In a priced round, the entrepreneur will often share their valuation ask (or a stated floor) for the pre-money valuation of their company much sooner in the process.

Let's personalize your content