The Pro-Rata Opportunity

Mark Suster has a good (and long as is his wont) post up on the topic of the changing structure of the VC business.

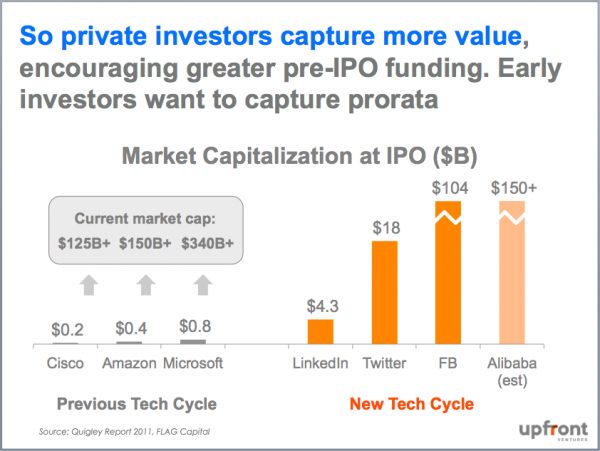

Mark focuses on something important that is probably not getting talked enough about when people talk about the VC business these days. I like this slide from his post:

“Capturing pro-rata” is sooooo important in early stage venture. You make 20 investments in a fund. One is going to return the entire fund. Two more are going to return it again. A few more are going to have strong outcomes and return it again. The rest are noise when it comes to fund returns (but you better not treat them like noise).

Guess what? Early stage VC is a lot like poker. You want to go all in on your best hands. And if you make a seed or Series A investment, you get something called the pro-rata right. That means you get to invest an amount in every private round going forward that allows you to keep your ownership at the current level. A pro-rata right in Facebook, Twitter, Dropbox, Airbnb, Uber, ……….. is worth a lot. And early stage investors get those rights for free in the early stage rounds.

At USV, we recognized this early on but did not know what to do about it. So we let our pro-rata rights go unused in Zynga and Twitter because we did not have the funds to take those allocations. Brad agitated about it. It bugged him. I was also unhappy about it but did not want to increase our fund size so that we could take these allocations. I strongly believe in small fund sizes. It’s a core of our strategy at USV.

So we came up with The Opportunity Fund. It’s a companion fund that is designed to “capture pro-rata” as Mark puts it. We raised our first one in late 2010 and our second one earlier this year. It has been a big success. It is now so much a core of what we do that we now raise an early stage fund and an opportunity fund as a pair. You can’t invest in one without investing in the other. They have different economics for the LPs because they require different amounts of work on our part and because we don’t want to commit to put the entire Opportunity Fund to work (we did not put the entire initial Opportunity Fund to work).

When a company hits escape velocity, the investors in the inside are the first (after the entrepreneurs) to realize it. And if you’ve watched hundreds of rockets go up in your career and dozens hit escape velocity, you start to be able to smell escape velocity coming. That means that “capturing pro-rata” is an opportunistic thing. Seeing something before others see it is one of the few legal and sustainable ways to make money that I know of in the investment business. And so having a vehicle to do this aggressively is a huge weapon in the hands of an experienced VC firm.

Yes it is true, as Mark points out in his post, that public market investors are also coming into the private markets in a big way to capture all of this valuation expansion that used to happen in the public markets. But they do not have the one thing that we have – the pro-rata right. And so using it becomes even more important.

I am glad that Mark took the time to write his post on this topic. It’s a big change that has happened fairly quickly in the early stage venture capital business (all post financial crisis) and the ramifications of it are important to entrepreneurs, VCs, public market investors, and LPs. I’m very pleased that USV has been early to this theme and a thought leader in it.

Comments (Archived):

Thanks, Fred. You certainly saw the trend before most. I guess it helped to have a ringside seat at some rockets to realize the importance of an opportunity fund. I have had the “opportunity fund” conversation with many GPs & LPs now. It seems that the industry norms on how to structure opportunity funds hasn’t started to settle into standards. Perhaps soon it will. And as I mentioned to you previously – I also see new potential conflicts arising from LP “direct investment vehicles” and VC “opportunity funds. Will be interesting to watch.

The thing that makes it challenging are the misalignment issues. To the extent that you pair an early stage and opportunity fund and the LPs are the same in each, you can minimize those issues

Should have read the comments further. This answered my question. Was investment in the opportunity fund offered exclusively to existing LPs?

Yes

From an LP perspective (non-institutional) who looks at smaller funds sizes (sub $500M) raising the two funds simultaneously isn’t ideal. It also lessens the opportunity to co-invest in successful investments as the GP will use the opportunity fund to cover the pro-rata and then some, not always, but as more people raise opportunity funds it will happen more. As an LP I value co-invest rights where fees are minimal and depending in the opportunity fund terms this could change the value and remove co-invest altogether. As a GP the opportunity fund fees need LP alignment.

I’m guessing that oppty fund fees are lower and that these funds are only called upon (reserved) for follow on rounds of successful earlier investments. Likely there’s no commitment to invest all the funds in an oppty fund…spent as the opportunity arises. From what Fred’s said, it sounds like the terms and alignment is likely built into the fund.

Yes, that is what I have been seeing. But what it’s potentially replacing is a co-invest opportunity where there is no mgmt fee, a one time mgmt fee and of course carry in both scenarios. From where I sit I will invest roughly the same amount or more directly into a co-invest as I will into the fund if the opportunity is right (depending on fund size) and this is what GPs need to be careful of replacing. We only look to invest in funds where we get co-invest rights.

Interesting. Thanks.

+1

Interesting. I met with a potential LP yesterday that gave me the opposite feedback. Told me they weren’t interested in sidecar rights at later stages.

Yes. That is what I’m hearing from LPs. Many already had a co-invest philosophy but many, many more are gearing up for it. It does create some LP/VC tension. I think Fred has been smartest about solving this. But it is a recurring theme I’m hearing as I’m out on the road.

I’m sure this also plays a big role for angel investors, although it becomes more difficult for some of them to continue following at successive higher raises. Is there a solution for that? For eg assigning their pro-rata to someone else who can afford to continue preserving it, in exchange for a % of the carry?

If its your own money then I think there comes a time when you can’t keep playing (unless you are a billionaire)

Hypothetically; After any angel investor does invest (with the pro rata), why cant they borrow from others?

This is true. I have invested only my own money. I try to make an objective decision on each round. Try to press my winners, and kill my losers-or companies that are not progressing. Seed is very different than VC. I read Gotham Gal’s post on this the other day-we see things similarly to a point.Suppose there is a company that you have a seed investment in. They have made 0 progress in the 12 months they have been around and now they are raising a new round. The round is flat (same valuation as before). Investors want to do another round to keep the company alive. Do you invest or not?I have been confronted with this choice and corresponding peer pressure. I looked at the risk/reward (which was unchanged) and decided to take the dilution hit and NOT invest.When I was trading, I tried to cut losers, and let winners run. Poker is a good analogy most people can understand. Your seed bet is the ante. Do you want to see the flop or not?I am not a billionaire. Been stung in more ways than one pretty badly since 2008.

@fredwilson:disqus / @msuster:disqus – do you guys see any of the of the large (or even smaller) traditional asset managers starting to notice this ‘missed opportunity’ and launching venture funds of their own so as to provide this risk/return opportunity profile to their own clients?I recognise that this would be substantially more difficult for them to achieve in comparison to their plain vanilla funds, given a) the lack of relationships that VCs build up over years with entrepreneurs and in the startup world in general, and b) these funds being potentially unattractive to entrepreneurs who know that VC funding is about far more than just the capital received.But given the latent potential of certain investments, and the funding requirements to keep up with pro-rata, is this something that you guys in your industry think about at all?

It would mean being in the VC businessThat’s a tricky thing to do if you don’t have a history of doing it

Very tricky, and there are FINRA rules etc that will make it tough on them.

Is it not conversely true as well? … when you reject a pro-rata offer … the entrepreneur can smell whether he has crossed the escape velocity and ready to fly OR a pay-load has been added to fuel the rocket?I am sure twitter (Dorsey) and zynga (mark pincus) were smarter one’s to smell it right.

btw, how do you get to your old gems while you are typing (gawk.it is it? Kevin would be happy)….the poker analogy is really good. Since i am not allowed to comment there i am commenting here…I really liked the paragraph on how it is different from poker when you have a bad-hand…merging and buying some market.

i’ve unsubscribed to Mark’s essays. a much reduced word limit and the discipline to write to it would get me back.

does he want u back?

i very much doubt he knows i exist.

Make noise, u may get something..

signal

auto spam all his future posts with your statement?

Cue the hand wringers accusing VCs of insider trading (“know something early and make money off of it.”)Hint: VCs get to do this as fair compensation for the inordinate early risks they took.

It’s not like we are trading against our customers, paying for order flow, or front running. VC’s aren’t investment banks.

🙂

.It can only be insider trading if it is both “material” and “non-public” and if it is being done at the expense of a legitimate trading opportunity. Most private stocks do not present legitimate trading opportunities.The antiseptic for all insider trading accusations is full, fair disclosure in which the information is no longer “non-public” even when it is disclosed as part of an investment prospectus.Disclosure is the answer for almost everything.JLM.

so you’re saying sometimes table stakes get too high for small funds to afford their pro-rata rights?- could you have sold those rights. are they transferable to other investors?- rather than have lost them could you have proactively ‘waived’ them for a fee payable by the company?

Great questions but honestly, I can’t see myself or one of my clients agreeing to allow those rights to be resold with no control over who the investor with such a large % would be in follow on rounds.

Definitely non-transferable. “Non-transferrable” is likely the most common word in any equity agreement ever.

maybe not officially ‘transferable’ but a non-USV entity could have stumped up the cash and used USV as a conduit to access the shares.

Hide the ball? That game never ends well.

or someone invents convertible pro-rata, an instrument than can be sold on

Usually you would transfer these rights to an “affiliate” which would ordinarily be a fund managed by the same general partner (USV in the present case), which would also be palatable to the founder/s.

Fred – I agree with you and Mark and although out first fund was very small, we also had the foresight to create a follow on vehicle for our pro-rata. In fact, our pro-rata vehicle had a no mgmt fee and a reduced performance fee for all exist LPsHow would you recommend an emerging manager deal with the issue of “Major Investor” language? In some of our deals where we come in early but not as the lead, the Major Investor does not offer many of these critical rights to the other investors. For the most part, we’ve chosen simply not to invest in these deals because pro-rata is so critical to out portfolio construction.

This also highlights the changes and problems with accessibility to the public markets for smaller companies, and I don’t mean tiny companies – look at valuations of Cisco, Amzn, or MSFT when they went public.

I have a “Missed Opportunity Fund”. It’s consistently outperformed against its thesis year over year. Remarkably, I have done this without pro-rata rights.

Paper trading always results in profits.

This creates another interesting signaling dynamic. If a VC doesn’t follow with their pro-rata rights, we don’t always know if it’s because of a budgeting issue, or because they stopped believing in the startup.Do you have any rules of thumb for the proper allocation that a fund should put aside for subsequent follow-ons. I’ve heard 2-3 times initial investment levels?

When I’ve raised follow on rounds there is no ambiguity about whether and why initial investors want in.You get to know your early investors well in a pre syndicate reality. You just ask them!

I agree with @awaldstein:disqus . Smaller funds can be upfront that they were not designed and can’t accommodate larger follow-on rounds. It’s the case every day with angel investors and small seed stage investors non-participation in follow on rounds.

Rule of thumb; If Fred stops investing, the company’s dead 🙂

If LP’s are obliged to invest in both funds, I’m struggling to see the difference between two smaller funds and one big one.

Different terms and conditions. And likely the big fund is only used for follow-ons in escape velocity companies…otherwise, big funds’ cash is not invested…whereas small funds cash has to all be invested.

That is clear. But the outcomes for the LPs would be the same in both cases. I suspect the reason is to keep each fund’s performance separate so it can be compared like-for-like with similar funds.

Big fund = bigger expectations and a totally different game plan / thesis. If all they had was one big fund, they couldn’t be an early stage investor unless they staffed up and made 100+ investments per year. So, to some degree, yes performance.

Yes, like for like is important. The opportunity funds would be compared with growth equity funds and considered growth equity from an asset allocation standpoint. The investing expectation may not be the same pro rata share in each fund, even if you are expected to invest $’s in both. Some larger funds have always done all cycles out of the same fund, but most of those do very little really early stage–very few seed rounds for instance. For a USV, Foundry, etc. it makes a huge amount of sense to have separate vehicles.The opportunity funds are typically going to have a much shorter time horizon for returns (call it 2-3 years, v 7 for a venture fund), lower return profile in absolute dollars (perhaps 3x, but can still be a very high IRR given the shorter time period), an expectation that the fund own’t lose money on any particular investment so not home run driven in the way a normal early stage VC fund is. Fee structure is often also very different. No management fee on uncalled capital for instance, sometimes no management fee at all or just a very small fee.

Different terms and different investment risk and return targets. Thr former is easy to understand. The latter is more nuanced but way more important

Fred – did you try or consider raising co-invest $ for the follow-ons? That’s one model I’ve seen work well to take up extra capacity while keeping the fund size small as well.

“Seeing something before others see it is one of the few legal and sustainable ways to make money that I know of in the investment business. And so having a vehicle to do this aggressively is a huge weapon in the hands of an experienced VC firm.”Great line, great post.

There is always a “but” and in here it is but its not “always” legal. Insider trading applies to private as well as public conpanies.

Well it is true that if you don’t disclose what you know to the seller, you might have an issue. But if the seller is the company itself, that is not possible

I’m not so sure. If, for instance, the selling company and one but not all of its first round investors are privy to discussions about a loss or aqusition a key customer, technology, or employee and the selling company raises money based on this. one could potentially have a problem.

Hmm. Sounds like you are saying that a smart VC will be eager to drink coffee with the CEO and get the ‘inside scoop’ earlier and better than the other investors. So, when the next funding round arrives, the VC, in the decision to do the follow on investment or not, will get a return on all that coffee.

Might not need to be that nefarious as in the case where one of the VC’s portfolio companies is the acquiree.

Partly I’m joking but not entirely. So,(1) Fred hasSeeing something before others see it is one of the few legal and sustainable ways to make money that I know of in the investment business.(2) You did mention “privy” (let’s not go into the etymology!).(3) In this thread I’ve been trying to clarify, at least in my own mind, to understand this latest lecture in Fred’s MBA Mondays on Thursdays, why the pro-rata right is valuable. I.e., take the lecture and do some exercises. So, I had the issue of the coffee.But for “nefarious”, there’s the JLM remark in this threadIt can only be insider trading if it is both “material” and “non-public” and if it is being done at the expense of a legitimate trading opportunity. Most private stocks do not present legitimate trading opportunities.So, maybe the coffee is not fully nefarious.

.If a company solicits an investment the burden lies with the seller and more importantly with the Board of Directors who must be able to prove they sold the stock for a “fair” price.Fair is a difficult standard to meet as a company with a need for cash arguably has a different standard than a company which is flush. Fair is in the eye of the beholder and is a fact based standard.It is not unusual for a company’s Board to obtain a third party valuation as well as a fairness opinion as it relates to any substantial placement of stock. The Board has to look to independent directors to rectify and deal with any and all conflicts of interest in such a transaction.The Board has to approve such a transaction and arguably direct participants have to recuse themselves from such a vote. When everyone gets recused it is not unusual to see a Board create a “special committee” to handle the Board’s duties.The company (Board really) ultimately has to discharge its duties with an eye toward representing the interests of ALL the shareholders. This is a very serious duty. One that is made infinitely more difficult when there are different categories of shareholders.This is the messiness of a Board but it is garden variety Board hygiene and just has to be done correctly.JLM.

If I can borrow your well known phrase, “Well Played”.

I’ve been thinking about this in the context of all the Angels and Angel Funds out there. These guys (as a group) are not generally inclined to continue investing in future rounds and usually let their pro-rata rights lapse. How interesting would it be to create an Opportunity fund that these investors can leverage (and share in the upside)?In many cases, claiming unused pro-rata rights is one of the few ways non-existing investors can get into a deal when they aren’t part of (or the lead investor in ) a new round of funding,

I like that idea.

me too.

Great article Fred, thanks for sharing. One of the important issues I see today for crowd funding is new investors lack of realization of the importance and value of pro-rata, which I addressed in my blog: http://www.yvcblog.com/?p=29

First, great post by you and by Mark, although I have to admit I prefer your brevity.Also, as a former MD of derivatives at Morgan Stanley, an angel investor and an entrepeneur for the last 10+ years, I think there has to be a way to “securitize” the pro-rata rights… keep it in the fund and then sell to 3rd party… I think this accomplishes several things1. Juices a small fund’s returns to unheard of IRRs2. Allows small, angel investors to reap the pro rata gains without large financial capital requirements3. Keeps the pro-rata value equally distributed (i.e. pro rata) among the original fund’s LPs. Oherwise I could see some of those LPs not being able to participate equally in the “Opportunity Fund”

Credit derivatives could also make its way into VC.

sounds fair/right/useful

Cute results although via means maybe questionably feasible to get accepted in practice.

Great post. A companion fund dedicated to pro-rata investments is a great idea for small funds. We’ve struggled with whether or not to exercise our pro-rata rights with a few portfolio companies. How did existing LPs react to formation of the companion funds? I could see potential conflicts arising. Were existing LPs offered any preferential rights in the companion fund (first right of refusal as LPs, better GP/LP split, reduced fees, etc.)?

The people who are likely getting screwed here are the employees. They are certainly taking all the risks.Take for example Uber and their $1B round at an $18B valuation (although any mega raise company will suffice).For the sake of argument let’s say Uber doesn’t work out and it is only worth $5B so google buys them for that price.The last VCs get their $1B back first. Money also flows back to the earlier rounds so they’re whole). The founders get nice carve outs (millions of dollars). The common shareholders get jobs (assuming they pass Google’s screening).Uber is certainly worth more than $1B.There’s a good chance though that Uber is worth less than $18B.There is a very small chance Uber is worth $25B+.The last scenario is the only way the common shareholders (the employees) get a return.I’m not sure why anyone would take a senior level job for the promise of equity with any of these companies that are raising giant private rounds.

they’re basically becoming speculators at that point.

I tend to believe that at this particular point, companies like Uber are able to pay much better salaries and rely less on equity as a tool to attract great professionals. Not that equity isn’t important, it clearly has a lot of value; but (and that’s a totally unqualified guess on my part) at some point, companies need more experienced professionals which tend to come from established businesses. The package for these professionals is probably different from the one that attracts the more risk taking first employees. I believe the new hires already adjust for the new reality of the (now large) startup.

I’m not sure I agree…As to the employees being screwed – part of the proposition is that as an early team member you forgo some upside potential in return for a steady paycheck.I had a employee who owned 5% of my company – and wanted more ownership. We came up with a plan to move him to significant ownership, but required him to take a cut in guaranteed salary and think more like an owner (we made a small base + profit share). He chose the safety of the guaranteed salary.Later, when we sold the company, he and his wife felt a bit screwed. I understand – but feel we treated him fairly. Had he made the modest investment and chose the more risky path, he would have shared more in the upside – just like us who risked both capital and paycheck.I agree that these giant valuation rounds skew the equation – but also know that some senior level executives at these companies are taking out big paychecks along the way…

.I agreeeeeeeeeeeeeeeeeeeeee more with you than you do with yourself.The tradeoff is timing — is the company a risky proposition in which the employee is risking their career? If so, then a spot of equity is in order. They took a professional and equity risk.If the company is now a going concern with real profits, then it’s just a job and doesn’t merit equity type returns as there are no attendant such risks.JLM.

It’s “just a safe job” and “we’re a going concern” are not the pitches that the recruiters are using when they are trying to hire.

A lot of these rounds that would have been public market issues a decade or more ago include a meaningful secondary component. This creates significant employee liquidity

True. But I’m also starting to hear that a lot of these companies are starting to put severe restrictions on employee secondary market private sales.Specifically I had heard one of these companies who had raised a mega round had blocked all secondary market sales but they were offering to buy back employee stock at a valuation of about half of the recently closed raised.

There is always more to these stories than is readily apparent when you get into the terms of the securities from a valuation perspective. Employees hold common stock, the new investors in the mega rounds hold preferred typically with some real preference rights. Take the Box/TPG deal because you can see the terms when you read the Cert of Incorp. Preference plus a growing preference if an IPO is not completed by a certain date at a certain value.Some people may be getting cute with the values but in a deal like Box/TPG, the terms of which are fairly common for these super high value later rounds, a pricing difference between common and the last round preferred would be completely supportable. In fact, if you didn’t have a pricing difference you would be crazy.

If the pro-rata right is really valuable, then it sounds like the entrepreneur is selling too cheap.Explanation: On average, the pro-rata right is not valuable. But, it can be valuable to an investor who knows enough to judge, one follow on investment at a time, when the right is valuable and when it is not, and in practice mostly only VCs who were early investors and have followed the company carefully to the round in question can know. So, additional investors, say, some hedge fund that only just heard of the company and the round, can’t really judge, has to be stuck with the average, and that is not very valuable. Right?That is, the pro-rata option is valuable much as is traditional in options, that is, the right but not the obligation to buy. And such an option can be valuable to an investor who knows more and, thus, when to exercise the option.But if USV is in, then that’s a signal, and then the entrepreneur might be able to take this fact to various other sources of capital and sell that fraction of his (her?) company for more? Then the pro-rata right would be less valuable, maybe not valuable at all, to USV?

all things will find equilibrium – yet pro-rata is a right. The value of pro-rata for all parties is savvy investor signalling if the angel’s sometime lack of deep pockets can be mitigated. Thus syndication of pro-rata rights allows for better signalling, faster/cheaper-for-the entrepreneur up rounds where deserved, more upside for Angels, less upside for those who didn’t have the courage to build whole cloth with scarce capital…and THIS really appeals to me. Who wants someone else to take your winning hand because the table ante keeps going up exponentially?

> syndication of pro-rata rightsYou’re saying that this can be doable, i.e., not violate part of the legal agreement of the original pro-rata rights?

I’m saying that a new arrangement could be formed going forward with new investments. Happens all the time – it’ll either fly or it won’t.

Maybe one challenge would be, inhttp://avc.com/2014/07/the-…above in this tread, JimHirshField’s”Non-transferrable” is likely the most common word in any equity agreement ever.Maybe another challenge would be that venture capital is in some ways a small club with, I’m guessing, their limited partners from an even smaller club. Might be tough to get many people in the club to change!E.g., it’s easy to guess that Fred likes the current term sheets, etc.

You can get around the syndication restrictions but it can take time, probably too much energy to do quickly on a deal by deal basis. Given permitted transfers to “affiliates” you can have the same manager raise new money from new investors to exercise those pro rata rights. This happens sometimes but is a hassle deal by deal.

I’m saying that a new arrangement could be formed going forward with new investments. Happens all the time – it’ll either fly or it won’t.

Brad Feld had a recent post similar to thishttp://www.feld.com/archive…and some of the comments talked about the possible signalling risk if the opportunity fund is not used when a portfolio company is raising money. Do you see that as an issue?

I wonder if there will ever be an ‘opportunity fund’ concept for angels. Seems they are worst positioned to capitalize on pro-rata rights, yet by the logic, they probably deserve it the most. Maybe someone will come up with a unique financing model for this.

I like the attempt at a poker analogy, but as an ex pro, it’s not about going “all-in.” its about not missing a bet, and leaving value on the table.Going all in is rarely the right move… why bet it all when betting $1.5 get’s you the same information/result?With that said, I couldn’t agree more and I love this post. Great juxtaposition to primack’s termsheet article a few days ago about the moral obligation of CEO’s to take their companies public for the sake of public good… womp womp.

Fred–A sort of related question…how do you view the onset of non-traditional late stage investors, whether relative to your opportunity fund or just generally? The hedge funds, buyout funds, mutual funds, etc. are very different players than the traditional late stage, growth equity funds like Summit, TCV, Meritech, etc. In some respect to me they seem great because the new players bring a lot of capital to the table and allow delaying IPOs. In others, it seems like the signal the boom may be over.I’m old enough to remember the influx of mutual funds and some hedge funds at the end of the dot.com boom. They mostly looked like fools and were awful partners in the companies that could not get public…some of the buyout funds and hedge funds in particular making investments this time around are not the best regarded investors, and are known for very sharp elbows when things don’t go their way.

Seeing a Lot more Angels ask for Pro Rata rights. Used to be the exception. Now the norm. And they are serious about using those right too, it seems.

Great read. This will go in my bucket of VC tips and tricks. As a startup CEO, I think it’s vitally important to know the minds and reasoning for the people you’re selling to. Thanks again @fredwilson:disqus 🙂

Hi Fred, I have a question about the mechanics of the second fund. How are the pro-rata rights transferred between the two entities? Also from what I understand, the equity in your original fund still gets diluted and those LPs aren’t able to benefit from The Opportunity fund?

Same LPs in both funds for exactly the same amounts AlexAll pro-rata provisions (or at least the vast majority) provide that they are transferable to affiliated entities

Fred, can you go into a little detail on the economics of the opportunity fund and how they differ from the standard fund?Also would be interesting to hear about the benefits of raising two simultaneous funds vs one larger fund with reserves for follow-ons. Another option would be raising SPVs specifically for large follow-ons or leading later rounds, a la SV Angel’s Pinterest Series F lead. Curious to hear your thoughts on all of the above.

In the Oppty Fund we take the same carry – 20%. We charge a much smaller fee but only on capital at work. That does two things. It means we have no incentive to out the Oppty fund to work and it recognizes that we are already being paid to work on many of these investments by the mgmt fee in the early stage fund

Thanks Fred!

to what extent is the pro-rata opportunity fund just a fund that exercises the pro-rata on earlier investments, and to what extent does it act more bullish and almost lead a follow on round/ drive demand for a follow on round?

Asking for pro-rata is asking for a LOT:If all the current investors and owners (e.g., founders) get pro-rata, then there can be no new investors. Then the old investors are the unique source of any new money; so, there’s reduced competition for terms for new money.So, if there is to be some new money, some current investors have and exercise pro-rata, and there is are new investors, then some of the current investors and owners without pro-rata will have to be diluted. E.g., founders can be diluted.So, pro-rata is one extreme. Being diluted is another extreme. It should be possible to find a reasonable case between these two extremes, i.e., not all of pro-rata and not so much dilution.E.g., suppose a new investor is willing to invest $20 million for 20% of the company and, thus, saying that the company is worth $100 million now. So, we can say what each share of stock is worth now. So, maybe agree that current investors can buy more stock at that price or some such.E.g., it’s been said, e.g., @JLM, “You don’t get what you deserve. You get what you negotiate.”. So, looks like founders should be careful about pro-rata and what happens to their dilution.

What’s that logo behind you in your avatar?#toosmalltobelegible

i know. i’ll never graduate.

Why?

Nice 🙂