Net Dollar Retention vs. Net Revenue Retention

VC Adventure

MARCH 4, 2021

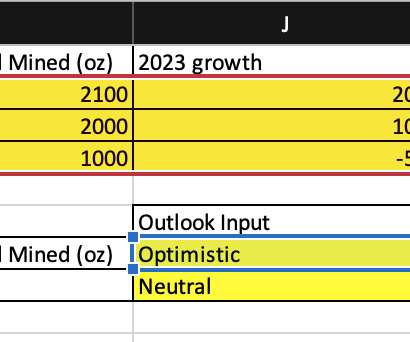

Net Dollar Retention (NDR) and Net Revenue Retention (NRR) are both important measurements in any business but many companies conflate the two or (more frequently) only report on one. Their effect on a business and can be hidden in aggregate data and a sense of their impact is lost.

Let's personalize your content