In December, AngelList, a service that matches early-stage startups with investors, debuted the ability to allow accredited investors to actually invest in startups on the platform with as little as $1,000. AngelList also partnered with SecondMarket to create an investment vehicle for these investments. The company is announcing that, since December, it has seen 1,100 investment commitments completely online, totaling over $6 million in funding for startups raising via AngelList. And today, AngelList is opening the platform up to all startups with top-tier investors.

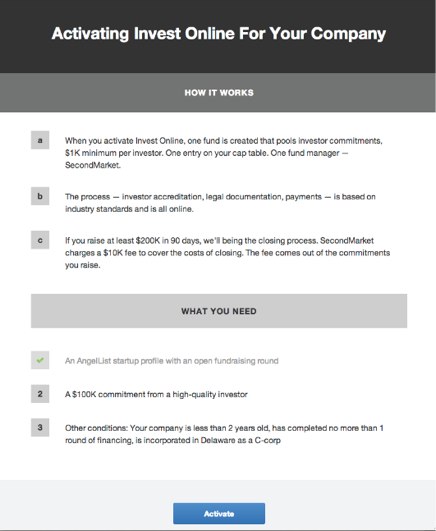

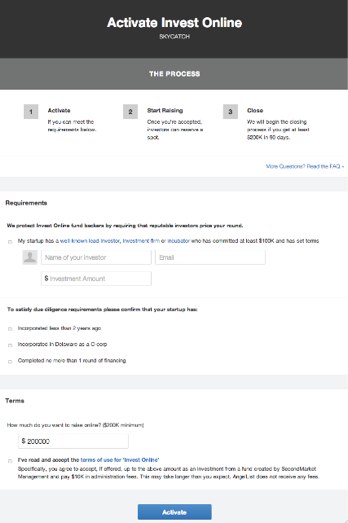

As we wrote last December, the investment tool lets accredited investors put as little as $1,000 each into startup companies that it’s created an investment vehicle for. Via SecondMarket, AngelList creates an LLC on the fly into which all the new investors go. That way, startups only have one entity in the cap table, which simplifies documentation and structure. The minimum for an individual’s investment is $1,000, but to create the fund, there needs to be $150,000 in investment (at the time).

There are around 12,000 accredited investors on AngelList, and via the SecondMarket Partnership, startups can reach another 20,000. In its base service (not the investing side of things), AngelList is helping drive 500 to 700 introductions between startups and accredited investors per week, and is helping raise on average $10 million per month.

The idea is to allow a larger number of individual investors to make small investments in interesting startups, but to do so in a way that reduces the friction of most funding rounds today. By putting this online, it increases the efficiency with which startups can get funded. And just a few weeks ago, the SEC gave the investment platform the greenlight under its regulations.

Co-founder Naval Ravikant explains that 18 pilot companies in the program, including Transcriptic, Double Robotics and Tred, received $6.7 million in commitments from 620 investors in the past four months, with about $2 million raised per month on average. Investors included Founders Fund, 500 Startups and Marc Cuban. Because of how well this worked, Ravikant decided to open up the platform more broadly. But there are still a number of requirements that startups have to meet before using the online investment feature.

First, AngelList Invest is available to any company on AngelList that has a top-tier lead investor. Using today’s data on AngelList, that includes 300 startups. Other criteria include that the startup needs to be U.S.-based, less than two years old, and have no more than one round of past funding. And the lead investor has to be putting in at least $100,000 in capital, says Ravikant. In order to create the SecondMarket fund, the minimum invested needs to be $200,000 (up from $150,000 at launch).

Ravikant explains that this feature is designed to encourage more startups to raise funding from legitimate investors via AngelList. “Instead of raising offline, you could get the bulk of your capital online without hassle. And you could incorporate both small and large supporters in a round without complication,” he says. He adds that this is the most open, in terms of startup criteria, that the investing platform will get. And what AngelList is doing differs from the crowdfunding market, with the criteria for startup participation and the requirement to be an accredited investor.

This is just the next phase of AngelList’s evolution into a one-stop shop for seed-stage companies and their backers. And AngelList has also morphed into a jobs and talent destination, adding 600 candidates per week, and facilitating 1,600 introductions per week (with more than 3,000 startups using AngelList to find talent).

It’s clear that AngelList wants to help bring much of the transactional conversations and introductions that happen at the early stage of hiring and fundraising via word of mouth or in meetings online. The site is also a data goldmine. No wonder the platform is rumored to be raising a round at a $150 million valuation or more.

Comment