Technology, Innovation, and Great Power Competition – Class 4- Semiconductors

Steve Blank

NOVEMBER 2, 2021

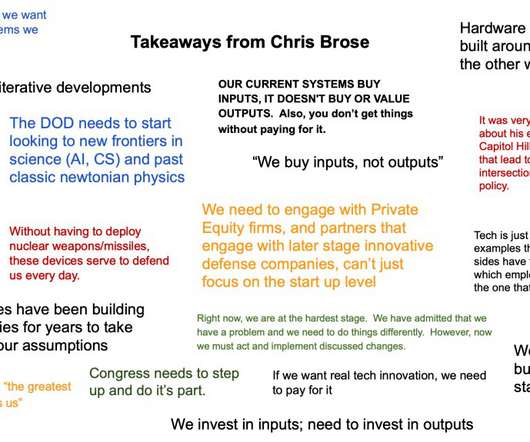

the government is painfully learning how to reorient its requirements and acquisition process to buy these commercial, off-the-shelf technologies. [Please watch the video, review the slides and blog posts]. Klaus Schwab, “ The Fourth Industrial Revolution: What it Means, how to Respond ” World Economic Forum , Jan. Optional Rebecca S.

Let's personalize your content