How To End Your Investor Pitch

There are thousands of articles and a few books including my book, The Pitch Deck Book: How To Present Your Business And Secure Investors, on putting together the best pitch deck for investors, but how should you end your pitch?

STOP USING QUESTIONS OR THANK YOU SLIDES!

I have seen thousands of pitch decks. I have coached hundreds of entrepreneurs through the capital raise process. I love helping people present better. Some areas of the presentation can take weeks to get dialed, while others, specifically how to end your pitch can take a few seconds to get right. Let’s help you get the end of your pitch dialed.

The end slide is the most important slide in the deck, assuming the rest of the deck is done well.

You just spent 10 – 15 minutes telling the most compelling story about why an investor should consider you and your team, the problem you are solving, why your solution is amazing and going to take over the world and then you hit them with this:

Getting a pitch to work in 10 minutes is not easy and it for sure is not enough time to tell me, the investor, enough about your business. Odds are I missed many critical parts of your presentation because I was taking notes. I heard you but didn’t have enough time to process the information and then you show me a big “Thank You” or “Questions” slide.

I probably see this happen on 95% of pitch decks and I get it, we have been conditioned to do this through school or speeches our entire lives.

This sucks for you!

This slide is such a waste of space. You have one last opportunity to remind me of why you are so amazing. What new information can I gather from this slide?

Nothing.

The final slide gets the most air time out of any of your slides. Therefore it should have the most information on it. It can have the most words as well, so use it!

Use this slide as a way to remind the investors about the problem and the solution, the ask and all the other details.

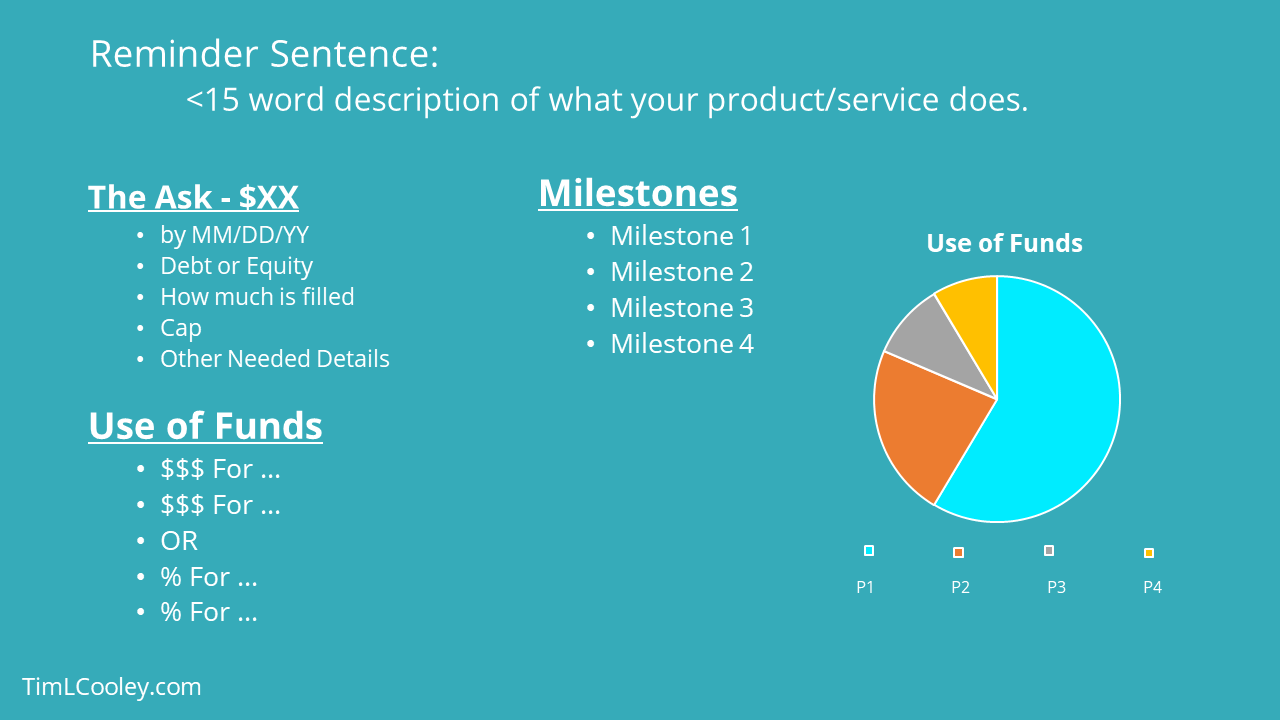

Here is what you should include:

1) Company Logo (not pictured)

2) A brief sentence about what the company does. (No more than 15 words)

3) The Ask

4) Terms of the deal

5) Milestones you plan to hit

6) The use of funds

7) Contact information

This seems fairly straightforward, you could just follow the template and be good, but there are still areas on this slide where you could make mistakes.

Font Size

Keep the font no smaller than 22, this goes for your entire pitch, especially on a slide with lots of words. A general rule is to take the oldest person in the room, divide their age by 2 and that is the smallest to consider. So if someone is 70, then no smaller than 35. You must also keep in mind the size of the room you are presenting, but generally less than 22 font size and it is way too small.

Pacing

Although there is a lot on this slide it doesn’t mean you need to restate everything. This is the “Ask” slide, so let the investors read what is here and focus on two areas, the ask and what you will do with the money. “We are raising $2M to hire 5 people to get version 2 of our product out the door, any questions?” You do not need to get into the details, verbally, of the raise as they are on the page. You don’t need to elaborate on hiring people. Keep this high level.

Questions

You want investors to ask questions. This slide is high-level enough to keep prompting questions, especially compared to the thank you slide above. This slides acts like a summary slide, so you are giving the investors time to think and recall all that has been said.

Changing Slides

Often you will have an appendix with slides that go deeper into parts of the business that generally get asked about. If you are forced to switch slides stay on that slide. There is no need to come back to this slide at the end of a question.

If you want to see some examples of pitches please check out The Pitch Deck Book or visit our podcast, PitchUs.io. We would love to have you on the show, so please apply and maybe we can help you with your pitch!

Gust Launch can set your startup right so its investment ready.

This article is intended for informational purposes only, and doesn't constitute tax, accounting, or legal advice. Everyone's situation is different! For advice in light of your unique circumstances, consult a tax advisor, accountant, or lawyer.