5 Effective Ways for Startups to Lower Customer Acquisition Costs

Up and Running

FEBRUARY 18, 2021

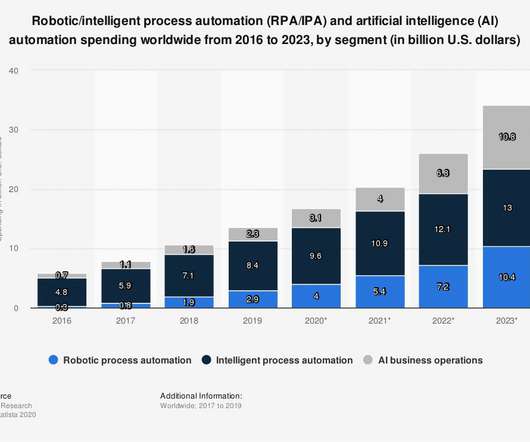

Having an excellent product and demand for that product is one thing. Customer acquisition drives sales and profit margins and it needs to be measured and balanced together with the customers’ lifetime value (LTV). We’ve already covered the use of automated processes in customer retention such as onboarding and in customer acquisition.

Let's personalize your content