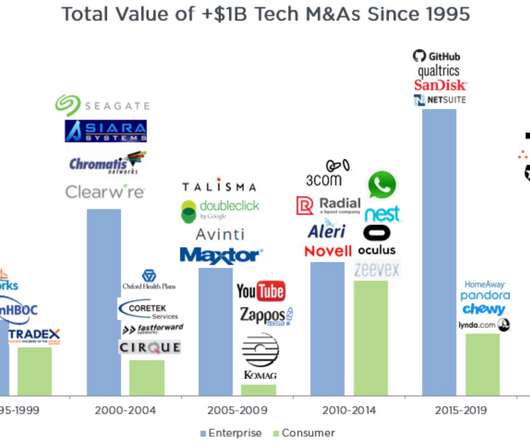

Corporate Acquisitions of Startups: Why Do They Fail?

Steve Blank

APRIL 23, 2014

More often than not the results of these acquisitions are disappointing. Companies manage these three types of innovation with an innovation portfolio – they build innovation internally, they buy it or they partner with resources outside their company. The goal is to get a corporate investment or an outright acquisition of the startup.

Let's personalize your content