Model Building from the Ground Up

ConversionXL

OCTOBER 6, 2020

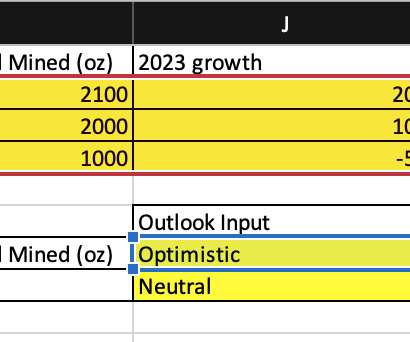

Is your KPI net present value of the project? The foundation of the model is the aggregate of the known information. Your objective, in this case, is to determine whether your $1 million should be invested in the plot. The next step is to determine your KPI. What you choose is critical—everything ties back to this step.

Let's personalize your content