What Your Cap Table Tells Investors About You and Your Company

Gust

JUNE 1, 2022

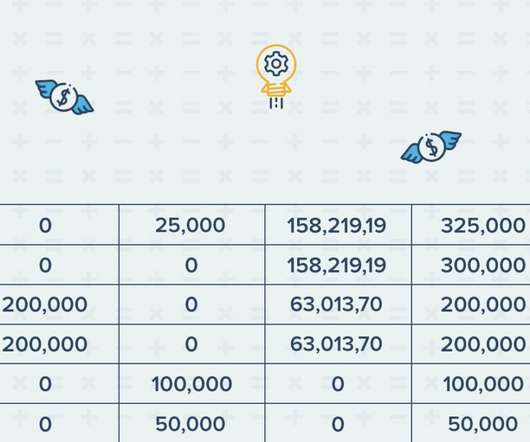

This post originally appeared on Startup Stack’s blog. If you have raised capital from investors before, you probably noticed that one of the first requests from potential investors is for you to send them your current cap table. Why would an investor be so interested in seeing your cap table?

Let's personalize your content