How To Secure A Lead Investor

Gust

SEPTEMBER 2, 2015

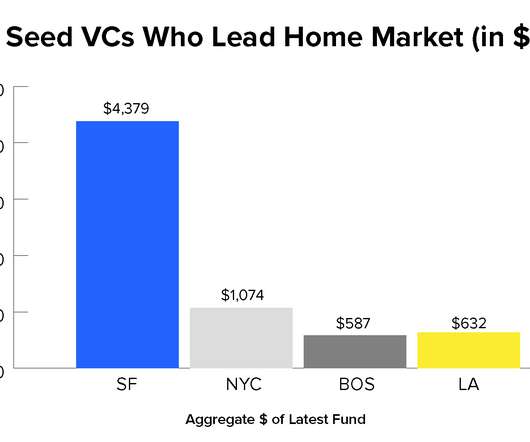

By searching for a lead investor in your next funding round. The lead investor is the first step in Read more >. The post How To Secure A Lead Investor appeared first on The Gust Blog. How do you continue to build your business?

Let's personalize your content