Some Good Startups Don’t Qualify For Equity Investors

Startup Professionals Musings

SEPTEMBER 8, 2019

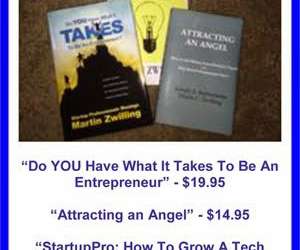

Angel investors and venture capitalists don’t make equity investments in nonprofit good causes. What options do they have available to them, since they can’t sell a share of the company (no equity investment)? There is no discussion of equity, or return on investment. Individual and institutional philanthropy. Marty Zwilling.

Let's personalize your content