This Has Been My Favorite Question Of Peers In 2021

“So, do you think your job is to win ‘consensus’ deals or find the ‘non-consensus’ opportunities?” This has been my favorite question to ask fellow seed investors over the last year, and the answers are telling. Some have very strong reactions, dismissing any alternate strategy to their own as imperfect. Others go back and forth in their own mind, realizing that their current execution, even if successful, is at odds with the words coming out of their mouths in response. Like most questions of this sort I don’t believe there’s an absolute correct answer but I do believe — now more than ever — one’s success as a seed VC depends on knowing *your* playbook and running it superbly.

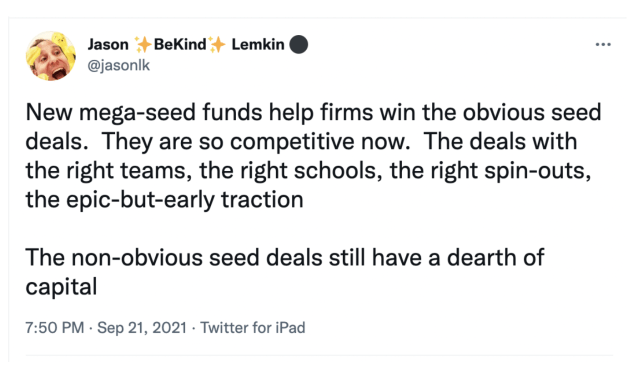

SaaS investor Jason Lemkin noted this the other day in the above tweet. There’s a lot of capital chasing ‘consensus’ deals, but this doesn’t necessarily mean you should avoid them as an investor if you have a legitimate shot at picking and winning well among them. There’s a historically true 2×2 that suggested the real money is in non-consensus opportunities, but it turns out that given the growth is size of outcomes, that “right” and “consensus” is still a fund returner, sometimes many times over.

Several of the seed VCs I respect most, and would put my own money into, have told me they shifted to high ownership and consensus during the last few years. It doesn’t mean they just care about pattern matching or social proof. There are still plenty of ‘hot’ deals they pass on and other investments they make which aren’t necessarily as well understood by the industry at the point at which they invest, but the scale of winners (and the ease with which they have ability to raise ongoing capital), along with increased size of their own funds, have made these firms less reliant on the needle in the haystack.

We’ve also seen a number of startup attributes which used to be considered ‘non-consensus’ become less disqualifying. Location for example. Go back 10 years and a startup outside a major tech hub would be a ‘non-consensus’ investment for most seed funds. So I think part of the flight towards consensus is also a broadening of what consensus looks like in a way that’s good for founders.

How would I describe Homebrew’s answer to this question? I believe we need to win our share of consensus deals in our core verticals (fintech, SaaS/FoW, etc) and when we know the founders already, but not let the volume of consensus dealflow overwhelm our ability to find and back non-consensus startups. One ‘trap’ is once you’ve earned your way into consensus-world, just living there. Unlike some of our peers I don’t think we can be successful deploying this model because our funds are (purposefully) too small to win every shootout. Also it’s a question of where your personal energy and motivation comes from. We get a lot of joy from working with non-consensus founders, even if it can be more effort, take longer, and possess greater funding risk.

Via Screendoor I’ve been looking at a lot of emerging managers from different backgrounds and I’m heartened to see a mix of consensus and non-consensus strategies. It would be wrong for underrepresented VCs to cede the ‘consensus’ deals to the establishment. They can fight and win their place on these cap tables and are doing so.

Consensus vs non-consensus strategies sort of reminds me of concentrated vs ‘spray and pray’ models. There’s a desire sometimes to assume one is fundamentally better or more pure than the other (I mean, spray and pray is really an index strategy, not a dartboard), but in actuality being very good at either model is a winning approach to venture. It’s not knowing which you are, or playing a game you’re not well-suited to win, that’s going to cause you trouble.