Conversion, retention and churn benchmarks

VC Cafe

FEBRUARY 21, 2023

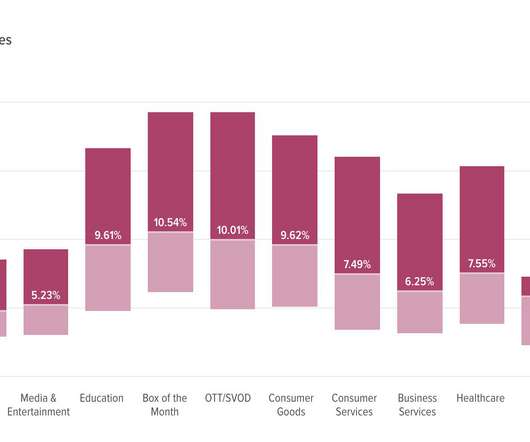

A high retention rate indicates that customers find the product or service valuable and are likely to continue using it in the future. Churn : The percentage of customers who stop using a product or service after a certain period of time, typically measured over weeks, months, or years. The benchmarks are based on the US market.

Let's personalize your content