How the pre-seed round made a comeback in 2024

VC Cafe

FEBRUARY 27, 2024

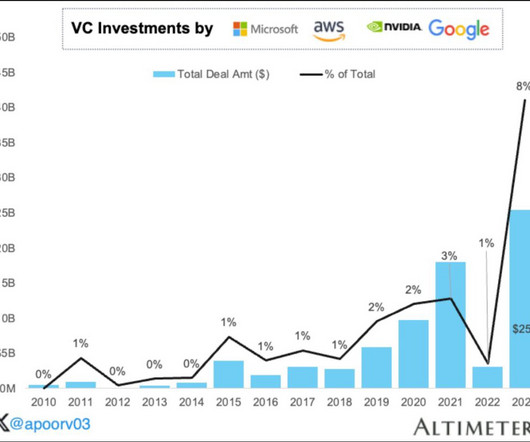

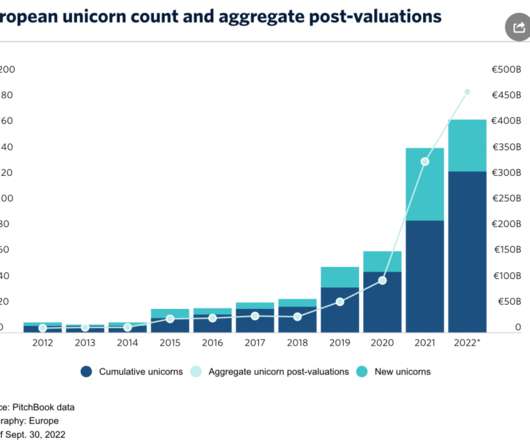

Everyone moved to earlier stage – part of the decline in late stage investing is the ‘baggage’ of companies that previously raised money at inflated valuations that they would struggle to justify in today’s market. The post How the pre-seed round made a comeback in 2024 appeared first on VC Cafe.

Let's personalize your content