How’s Venture Capital Changing in 2023

VC Cafe

FEBRUARY 27, 2023

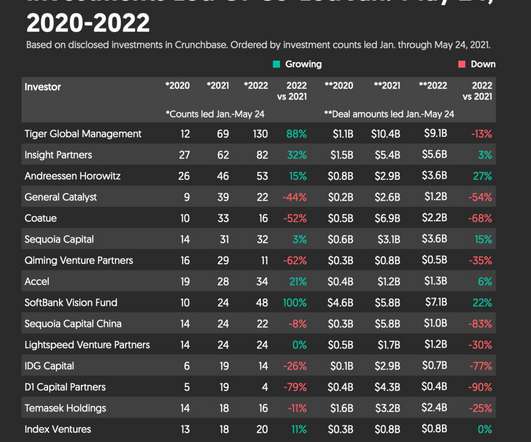

Taking stock of the venture capital market in 2023, it’s clear to see that we’re in a transition point. Prices went up from round to round, and startups were encouraged to grow, grow, grow, and not to worry about profitability.

Let's personalize your content