It’s an age-old scenario: You’re building a company, you have a product idea, and you’ve got the framework laid out in your head, but you want some expert advice and guidance on how to take the next steps. So, you go out to find a veteran entrepreneur, ask her to be an advisor in your fledgling company … and then what?

This is where a lot of founders get stuck. Entrepreneurs want to compensate their mentors and advisors for the time they dedicate to helping their businesses grow, but they have no idea how much equity to offer. Not to mention, once the founder and advisor have nominally agreed to a relationship, law firms enter the mix and seed the new advisor with a mountain of paperwork — legal agreements, options agreements — documents stuffed with legalese and binding statements. Just this hassle alone is sometimes enough to scare an advisor away from the relationship, at which point both sides lose.

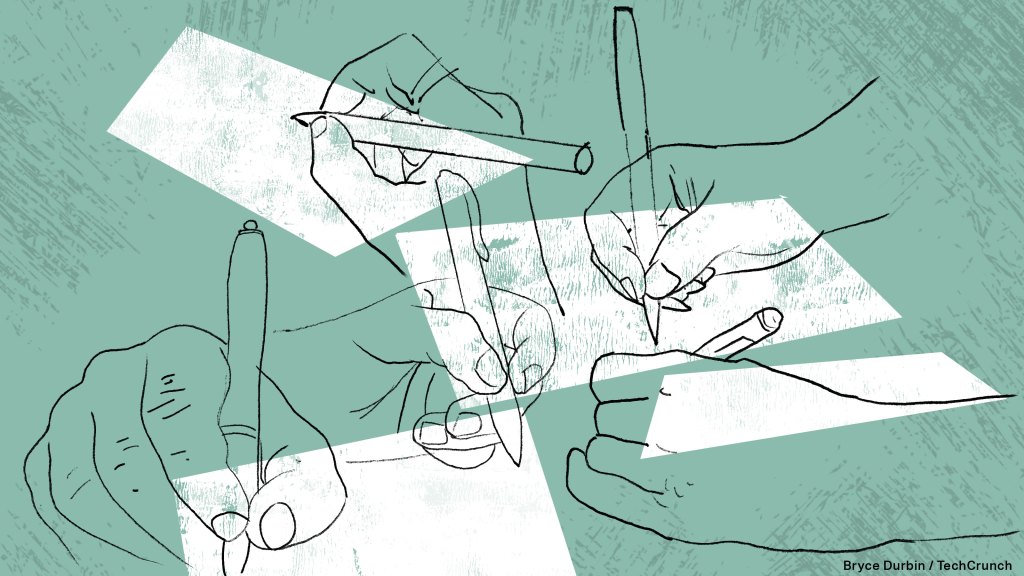

So, the Founder Institute has developed a solution to this long-standing pain in the ass that all startups experience. After speaking with dozens of founders, mentors, advisors, and startup teams, the startup accelerator and network is publicly releasing what it calls the “Founder Advisor Standard Template” (FAST), a free document designed to provide founders and advisors with a simple legal framework to formalize their relationship without all the legal chaos.

“We’ve been seeing at least one post per week on TheFunded concerning mentor compensation”, said Adeo Ressi, the founder of both Founder Institute and TheFunded.com (a site focused on revealing the inside truths of the Venture Capital world). Having to invent ad hoc terms to work together, negotiating terms, and throwing money into hiring lawyers can really hamstring the formation of productive founder-advisor relationships — something that can really make or break a startup in its early stages.

This is where FAST enters the picture, which Founder Institute has developed in conjunction with the Orrick Law Firm and Silicon Valley entrepreneurs, to standardize the process and remove the hassle, cost, and delay to the formation of these relationships. Now, with a few signatures and a couple of checkmarks, founders and advisors can decide (in minutes) how they want to work together, what to accomplish, and how much equity will be in play.

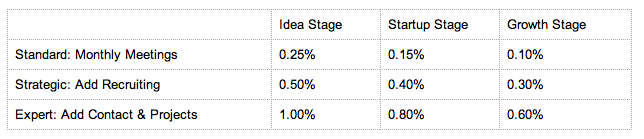

In an effort to standardize the process with FAST (and let everyone just get back to building great companies), Founder Institute and Orrick have denoted three “levels of company maturity” that have different implications for how to define the advisor-founder agreement: idea, startup, and growth. In addition, they qualify the terms with three “levels of engagement” that define how advisors will work with founders and have varying influence on how they are compensated: standard, strategic, or expert.

For example: If an advisor meets with the founding team monthly, is involved in recruiting talent for the business, and takes a few customer calls, then that advisor would be entitled to 1 percent of the company in the form of restricted stock or options, vesting over a two-year time frame. For a growth stage company, in comparison, this level of engagement would earn an advisor 0.6 percent.

What’s more, the idea here is that the agreement is codified by the two parties in such a way that it meets the minimum legal requirements but is flexible enough to allow advisors to end the relationship in as little as five days, for example. Traditionally, both beginning and terminating these contracts can take weeks — even months.

But what’s so cool about this is that, in the spirit of this flexibility, the team is architecting the document by way of crowdsourcing. This means that, until they finalize the agreement (Ressi tells me that the target date is September 30th), they will be taking the input of readers, founders, startups, and beyond, incorporating the best feedback into its development. In particular, Ressi said, the team is interested in reactions to the above equity matrix.

So what do you think? Does this seem like a sound system and a fair method of compensation? Let us know in the comments section, where members of the Institute will respond.

For more, see the FAST document below: